Become Work Optional. Fire Your Job With Dividends

Because Who Wants To Work A Miserable Corporate Job Forever?

Most people don’t love their job. They tolerate it.

They show up out of obligation, not inspiration. They count down to Friday, dread Monday, and dream of a day when their time is truly their own. I know because I am speaking from experience. My corporate experience spreads out across different industries for several large companies. Through it all, I never quite enjoyed what I did. I even had the opportunity to work at a video game company but I quickly learned that meaningless spreadsheets and meetings took away any sense of enjoyment I had.

The problem is, that day always seems decades away. Retirement is packaged as some distant finish line, tucked behind years of commuting, meetings that drain your soul, and doing work that rarely feels meaningful. And yet, we’re told that this is just how life works. That we should be grateful for a paycheck, grind until 65, and then we get to enjoy what’s left.

But what if that timeline is broken?

What if you could start buying your freedom now—piece by piece?

That’s exactly what dividend investing is helping me do.

I didn’t want to spend forty years of my life trapped in a system where my income stopped the moment I stopped showing up.

At some point, I stopped asking, “How can I make more money?” and started asking, “How can I get my time back?”

That question changed everything.

It led me down the path of building income that shows up whether I’m working or not. Income that buys me choices. That quiets financial anxiety. That lets me work because I want to—not because I have to. Building the habit of aggressively investing every single paycheck led me to accumulate $100K by the time I was 25.

How to Reach Your First $100K (Even If You’re Starting From Zero)

They say the first $100,000 is the hardest. And they’re right. It’s not just about the number. It’s about proving to yourself that you can do hard things, that you can build momentum, and that your financial future is within your control. The journey from zero to six figures is about mindset, discipline, and stacking small wins over time.

How Dividends Are Buying Back My Time

Dividend investing is simple on the surface. You buy shares in companies or funds that pay you to own them. But what it actually creates is something much deeper. It builds a sense of security that your income doesn’t depend entirely on your energy, your health, or your job title.

Every time a dividend hits my account, I feel something that a lot of people don’t get to feel at work: progress. Tangible, automatic progress toward a life where time belongs to me again.

Right now, my portfolio pays me over $3,000 per month and I’m aiming to reach $8,000 per month. That’s money I don’t have to work for. It covers groceries, utilities, basic expenses, and more importantly, it lowers the pressure. It gives me the space to breathe, think, create, and live on my terms.

The Dividend Stack Strategy: How I’m Building $8K/Month in Passive Income

What if your portfolio could cover your entire lifestyle without ever selling a single share?

While I’m far from being rich or fully at the level of financial independence that I’d like, it put me in a ‘Fuck You’ position. I was unhappy at my last job and wasn’t entirely reliant on the paycheck. And really this is what it’s all about: options.

If you’re reading this, it’s likely that you just want the opportunity to do what the fuck you want to do. In order to get there, you just need to be consistent.

You Don’t Need to Be Rich. You Need to Be Consistent.

Most people think they need to be a millionaire to live free. They don’t. What they need is consistent cash flow and the discipline to build it over time.

I started with small amounts. I reinvested every dollar I earned. I focused on high-quality dividend payers, REITs, and select high-yield ETFs. I didn’t try to time the market. I just showed up every month and bought income-producing assets.

It felt slow at first. But then I started noticing that the payouts were growing. My portfolio was quietly building a paycheck that didn’t need my time to grow. That’s when it clicked: I wasn’t just investing for the future, I was investing to create options right now.

Start with what you can. I don’t care if that means only investing $20 a check. Just get started. If you need a guide on where to begin, there are plenty of free resources out there for you.

How to Start Investing: The Simple Starter Portfolio That Actually Works

👣 Getting Started: The First Step Is Simpler Than You Think

When I talk about financial freedom, I’m not just talking about retirement. I’m talking about having enough income from your portfolio to cover your basic needs. Because once your essentials are paid for, everything else becomes optional. You stop chasing every dollar. You start focusing on what you actually want to do with your time.

That’s the first real taste of freedom. Not millions in the bank. Not retiring to the beach. Just waking up one day and realizing that if you walked away from your job tomorrow, you wouldn’t panic—you’d have time to figure it out.

What I Teach Can Help You Get There

Everything I write, teach, and share is designed to help people like you move closer to that freedom. I don’t believe in fluff. I believe in building income that’s real, repeatable, and resilient.

I’m not selling you a fantasy. I’m offering a framework. A mindset. A way to build something steady, even if you’re starting from zero.

You don’t have to wait until 65 to start living on your terms.

You don’t have to hate Monday mornings forever.

You don’t need to be rich—you just need a plan.

Dividend income won’t fix your life overnight. But it might be the first time your money starts working for you instead of the other way around.

And over time, that might be the most freeing thing of all.

🧰 Tools to Build Your Own Income Stack

Want to get a well-rounded idea of where to start your investing journey? I have you covered here as well!

📊 Tool: Track Your Progress

Want to keep track of what you're earning, how much your portfolio yields, and where to reinvest?

📥 Dividend Tracker Template – $5

Simple, powerful Google Sheet to track your holdings, income, yield-on-cost, reinvestment, and more.

📘 Full System: Go From $0 to $500/Month in Income

If you’re ready to build a scalable dividend income portfolio from scratch, with real structure, strategy, and support. You can start here:

🚀 The Dividend Income Blueprint – $25

My complete guide that shows how I built over $3,000/month in passive income using a three-layer dividend system, reinvestment strategy, and sustainable yield portfolio design.

It includes:

The strategy I use

Portfolio structure breakdown

Real examples + reinvestment tactics

Income planning + risk controls

Bonus: Checklist, glossary, & asset filters

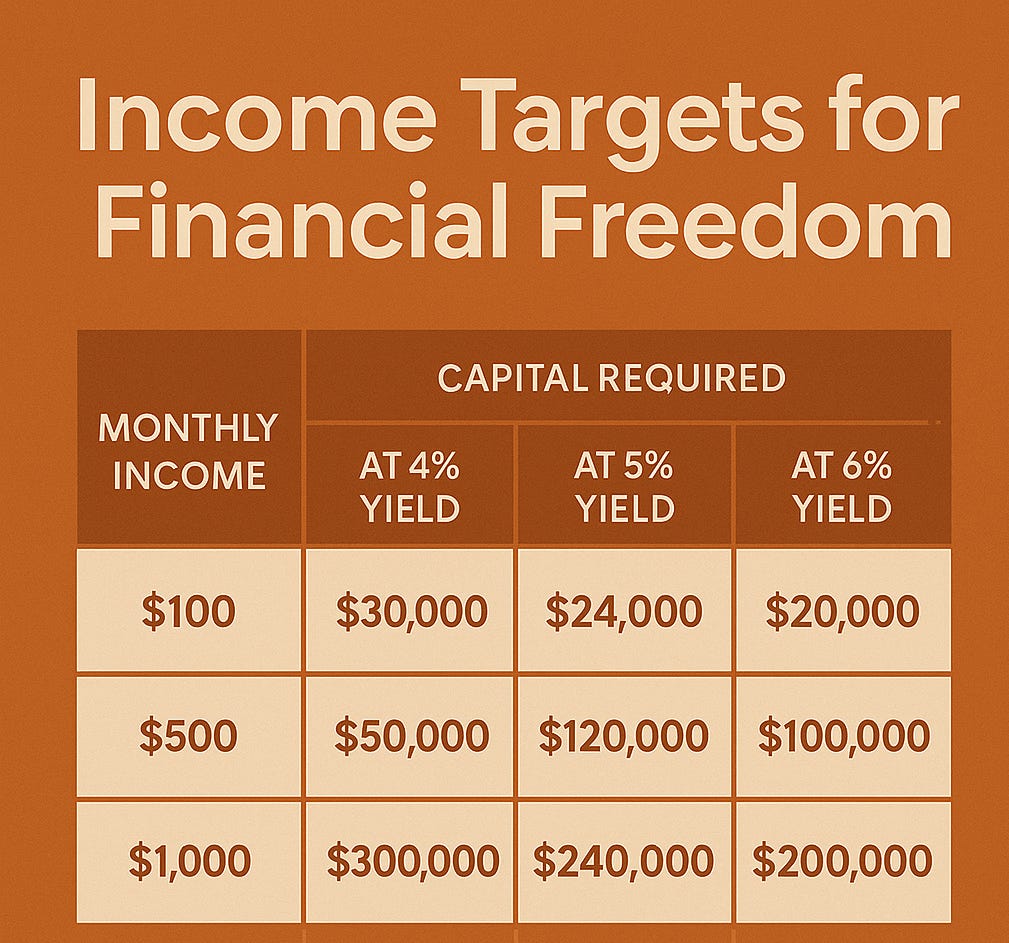

The Math Behind Buying Back Your Freedom

You don’t need to guess your way to financial freedom. Dividend investing is a game of consistent math, not magic.

If your goal is to earn $1,000 per month in dividend income, that’s $12,000 per year. Now divide that by your portfolio’s average dividend yield.

Let’s say your portfolio yields 6%. Here's the formula:

$12,000 ÷ 0.06 = $200,000

That means you need roughly $200,000 invested in a well-structured portfolio yielding 6 percent to generate $1,000 per month in income.

But here’s the part most people miss:

If your portfolio grows over time, your yield-on-cost increases

If you reinvest those dividends in the early years, your capital compounds faster

And if you focus on dividend growth, your income stream rises even without new money added

Now let’s scale that down.

Want to earn $100 per month to cover your phone bill?

$1,200 ÷ 0.06 = $20,000

That’s your target at a 6% yield. Totally doable over time, even starting from scratch.

This is why I stress building a system, not picking stocks blindly.

Income is just the output—the real power is in the structure.

You can start with:

A few reliable ETFs like FDVV, JEPI, or VYM

REITs like O, ADC, or WPC

Your job is to build a consistent pipeline of capital that flows into these assets. Every single month. This is how you turn your portfolio into a paycheck.

Why This Might Be the Greatest Dividend Growth ETF Ever Created

We are living in an era where inflation is no longer a background risk. It is front and center. While it has cooled from its 2022 peak, core inflation in the United States still hovers above the Federal Reserve’s two percent target, and many essential goods and services continue to rise in price year over year.

✅ Your 30-Day Dividend Freedom Checklist

You don’t need to overhaul your entire life to start moving toward freedom. You just need a plan and the willingness to take the first few steps.

Here’s a simple 30-day roadmap to start building dividend income that buys back your time.

Week 1: Build the Foundation

Open or review your brokerage account (Roth IRA, traditional, or taxable)

Write down your monthly expense baseline (what you need to cover your core lifestyle)

Define your first target:

“I want to earn $100/month in passive income within 12 months”Read or re-read the prospectus of a fund or REIT you already own or are curious about

Week 2: Pick Your Income Assets

Choose 1–2 dividend ETFs, REITs, or stocks to start or add to your portfolio

Focus on consistency, coverage, and sustainability over yield alone

Use a free tool or dividend screener to compare yield, payout ratio, and dividend history

If you already hold a few, reinvest any dividends received this month

Week 3: Automate & Simplify

Set up automatic contributions, even if small ($25–100/week)

Enable DRIP (dividend reinvestment) for all eligible holdings

Remove or unsubscribe from one source of noise or hype that distracts your investing discipline

Journal: “What does financial freedom mean to me?”

Week 4: Expand Your Knowledge & Clarity

Watch or read one in-depth piece on REITs, dividend ETFs, or income-focused funds

Reflect: Are you aiming for growth, income, or both?

Create a personal Dividend Income Goal Sheet (e.g. $250/month = groceries, $1,000/month = rent)

Share your goal with someone or write it down in a place you’ll see daily

🎯 Bonus: After 30 Days, Ask Yourself…

Do I feel more in control of my money and my time?

Am I building income that works for me, not the other way around?

What’s the next $100/month I can unlock through dividends?