How I’d Build $100/Month in Passive Income From Scratch (Even Without a Lot of Cash)

This Is How To Achieve $100/Month Dividend Income Plan. Start Small, Earn Forever.

$100 a month.

It doesn’t sound like much, right?

Maybe it covers your phone bill. A tank of gas. A grocery trip.

But here’s the secret most people overlook:

That first $100/month is the most important money you’ll ever earn.

Because once you can generate $100 in passive income consistently, without trading your time, you’ve proven the model works. You’ve turned money into a cash-flowing asset. You’ve planted the seed of a system that scales.

And here’s the best part:

You don’t need $50,000 to start.

You don’t need fancy software or risky bets.

You just need a plan, a few simple building blocks, and time.

In this post, I’ll show you exactly how I’d build a $100/month passive income stream from scratch, even if I was starting with limited capital.

No hype.

No overnight success stories.

Just real income, built the boring way:

With dividends, discipline, and a repeatable process.

Step 1: Break Down the Goal

Let’s reverse-engineer it.

$100/month in passive income sounds great. But what does that really mean?

💵 $100/month × 12 months = $1,200/year

Now let’s work backwards using dividend income math.

Assume you aim for an average portfolio yield of 6% (a realistic target with a mix of high-yield and moderate-growth dividend stocks).

To generate $1,200 per year at a 6% yield, you’d need:

$20,000 invested.

Now before you roll your eyes and say, “I don’t have twenty grand laying around,” let’s break that down even further.

That’s without even factoring in dividend reinvestment or capital appreciation. If you’re reinvesting those dividends (and you should be), you’ll hit your goal faster.

And here’s the real mindset shift:

You don’t need $20,000 on Day One.

You just need to start feeding the machine.

This is a game of consistency, not capital.

Every $1,000 you invest at a 6% yield gets you $60 closer to your goal forever.

Stack that enough times, and you’ll wake up one day with a portfolio that prints $100/month while you sleep.

What I’d Do With $1,000 Right Now If I Wanted to Start Building Passive Income

Let’s be real. One thousand dollars is not life-changing money.

Step 2: Focus on Monthly-Paying Dividend Stocks

When you're trying to build income from scratch, momentum matters. One of the fastest ways to build that momentum? Use stocks that pay you every single month.

Why?

Because monthly-paying dividend stocks do 3 powerful things:

Reinforce consistency – You see income showing up more frequently, which makes it easier to stay motivated.

Accelerate compounding – More frequent payouts = more opportunities to reinvest and snowball.

Create real-life cash flow – You’re building toward actual bill-paying, not just abstract growth.

🔍 Here’s what I’d look for:

A mix of monthly payers with decent yields (5–10% range)

Reliable payout histories

Moderate risk (REITs, BDCs, income-focused ETFs)

Blended average yield: ~8.7%

With just $14,000 invested in this blend, you'd already be close to $100/month in dividends.

You don’t need all six positions right away.

Start with two or three. Add monthly. Reinvest everything.

Let the payouts help fund your next purchases. That’s compounding in real time.

If you’re interested in monthly paying funds, I’ve put together a lit for readers.

Want to get a well-rounded idea of where to start your investing journey? I have you covered here as well!

📊 Tool: Track Your Progress

Want to keep track of what you're earning, how much your portfolio yields, and where to reinvest?

📥 Dividend Tracker Template – $5

Simple, powerful Google Sheet to track your holdings, income, yield-on-cost, reinvestment, and more.

📘 Full System: Go From $0 to $500/Month in Income

If you’re ready to build a scalable dividend income portfolio from scratch, with real structure, strategy, and support. You can start here:

🚀 The Dividend Income Blueprint – $25

My complete guide that shows how I built over $3,000/month in passive income using a three-layer dividend system, reinvestment strategy, and sustainable yield portfolio design.

It includes:

The strategy I use

Portfolio structure breakdown

Real examples + reinvestment tactics

Income planning + risk controls

Bonus: Checklist, glossary, & asset filters

Step 3: Reinvest Everything Early

In the beginning, your dividend income will feel small. Maybe it’s $4.17 from one ETF. Or $8.96 from a closed-end fund.

That’s not failure.

That’s the foundation.

Early on, you don’t want to spend your dividends, you want to reinvest them. Automatically. Relentlessly. Even if it feels like nothing.

Because here’s what most people miss:

The power isn’t in the payout, it’s in what the payout buys you next.

Every dollar you reinvest buys more shares, and more shares create more dividends. That creates a loop:

You earn dividends.

Those dividends buy more stock.

That stock increases your next dividend payout.

Repeat.

It’s called a flywheel and once it starts spinning, it gets stronger with every turn.

Example: DRIP in Action

Let’s say you invest $2,000 in a fund paying a 10% annual yield. That’s about $200/year in dividends, or $16.67/month.

If you reinvest that every month:

By year two, you’re earning dividends on more shares than you started with.

By year five, you could be collecting 25–40% more income without putting in any more money.

This is the magic of compound income and it’s how small portfolios grow into cash-flow machines.

How to Set It Up

Use DRIP (Dividend Reinvestment Plan) with your brokerage. Most offer this for free.

If you’re using a high-yield ETF or CEF, enable auto-reinvest, even with fractional shares.

If you're managing manually, collect dividends in cash and schedule a monthly reinvestment.

Step 4: Layer in High-Yield + Growth Hybrid Holdings

A common mistake new dividend investors make is chasing the highest yield possible.

Yes, that 14% yield might look incredible but if the payout gets slashed or the share price collapses, you’re left with neither income nor capital.

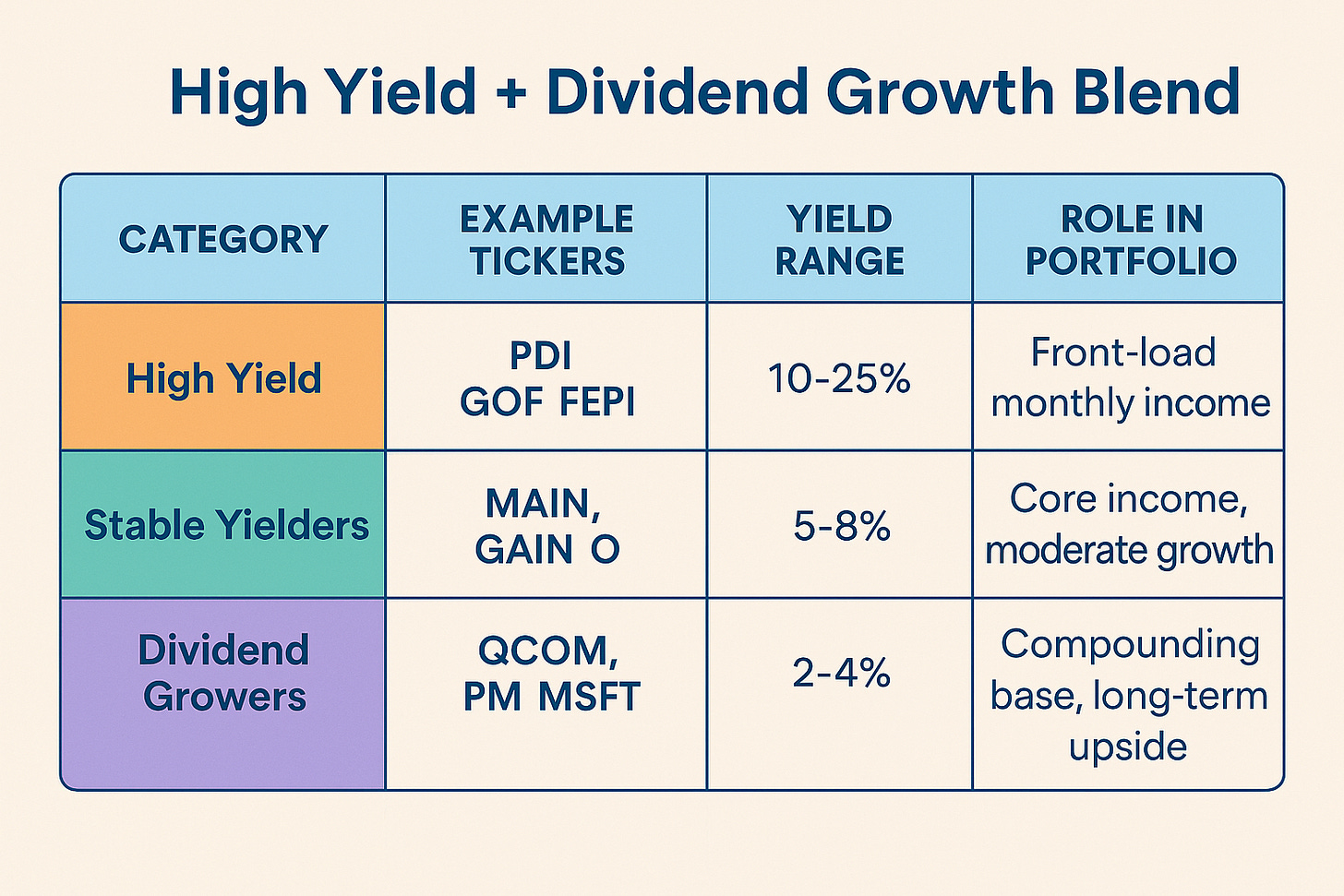

That’s why I build a hybrid approach:

One part high-yield for immediate cash flow, one part dividend growth for long-term compounding.

⚖️ The Power of the Blend

Let’s say your goal is $100/month in dividends.

You could build a portfolio like this:

This blend gives you cash flow now while compounding value in the background.

Think of it like planting two crops:

🌾 One for harvest today

🌳 One for harvest for the next 20 years

📈 Why Dividend Growth Matters

These companies grow their earning and their payouts year after year.

That growth protects your income against inflation.

It also increases your future yield-on-cost, even if the starting yield is lower.

Example: If a stock yields 3% today and raises its dividend 8% per year, your income from that investment will double in under 9 years without adding another dollar.

🔄 Rebalancing Tip:

Every 6–12 months, review:

Are your high-yield positions still stable?

Are your dividend growers increasing their payouts?

Is your portfolio drifting too heavily in one direction?

This keeps your income stream both strong and sustainable, two things most investors sacrifice by chasing only one.

✅ Final Thoughts: Start Small, Think Long

Building $100/month in passive income might sound small to some but for most people, it’s a massive mindset shift.

It’s proof that you don’t need to time the market.

You don’t need six figures in the bank.

You don’t even need to get everything perfect.

You just need to start.

Because $100/month is more than just an income milestone. It’s a foundation:

It pays real bills.

It proves your system works.

And most importantly, it scales.

If you can build $100/month in passive income, you can build $500.

If you can build $500, you can build $2,000.

Wealth isn’t about chasing the next big thing.

It’s about stacking small wins that never go away.

So whether you’re starting with $100, $1,000, or just a weekly habit, you’re not late. You’re right on time.