Introducing the gateway to passive income: dividends. Dividends are regular payments made by companies to shareholders, sharing their profits. It’s an excellent way for investors to earn returns on their stock investments. The barrier to entry on investing is super low. Anyone can start investing for free. Keep in mind, not all stocks offer dividends. So, if you want to invest for passive income, choose dividend stocks wisely. An important thing to know before investing into dividend stocks, is to have a strong understanding of your finances.

Passive Income From Dividends

Now, let’s explore why dividends are the definition of passive income. While other sources of passive income may still require some attention, such as having rental properties or running an online business, dividends are exceptional to have coming in during a time of high inflation and higher interest rates. With minimal effort, you can create a portfolio of dividend stocks that yield a steady 3%-6% cash flow each year.

There are even businesses out there that you can invest in that pay much more in dividends. I have a portfolio of 44 different stocks that pay me an average of $3,000 per month. Some of these positions yield over 10% annually! I share those monthly breakdowns in my dividend reports.

But don’t expect this to happen overnight. Building a significant income through dividends requires consistent investment contributions. Typically, these contributions are best outside of a 401k if you have any goals of using this cash flow to fund an early retirement. However, with smart investment choices, you can enjoy a generous monthly income of $1,000 or more without lifting a finger once the portfolio is set up.

Retire On Dividends

In fact, there are plenty of people in this world who spend years building the perfect portfolio so they can live off their passive income created by dividends. Check out an interview with my buddy, TheDividendMonster.

How To Get Paid

So how do you earn passive income from dividend stocks? Simple. Buy shares in a company that pays a dividend. You will need a brokerage capable of buying stocks. Plenty of brokerages offer free accounts. It’s quick and easy to get an account open on Robinhood for example. Once the account is open, the brokerage handles the rest. You simply hold the stock and you will be alerted when dividends are paid your way. Typically, companies pay quarterly (every 3 months).

For instance, consider the case of Pepsi, whose stock price went up in value by over 10% per year, all while giving you a steady 3% dividend yield. Why choose Pepsi? Well for me, I love looking at companies that we consume often and have really recognizable brands. If you are wondering where to start, perhaps consider investing in what you consume. Dividend stocks, in comparison to growth stocks, have a more stable price appreciation, making them ideal for those seeking passive income.

Dividend Tax Benefits

Another reason to love dividends is their favorable tax treatment. Dividends are subject to a set of specific income tax rates, but if they qualify for long-term capital gains tax rates, they receive tax benefits. Depending on your income, you may even pay no taxes on qualified dividends.

Check out this helpful table on dividend taxes by the Motley Fool.

Different Investing Approaches

To invest in dividend stocks, you can explore various options:

Dividend Aristocrats: These are companies with at least 25 consecutive years of increasing dividends, offering stable income and long-term growth potential. If a company is able to increase their dividend payments to investors for 25 years consecutively, it may be a good place to start your research. You can see a list of recent Dividend Aristocrats here.

High Dividend ETFs: Investing in Exchange-Traded Funds (ETFs) that focus on high dividend stocks can be an alternative to individual stock holdings.

Real Estate Investment Trusts (REITs): REITs invest in real estate properties and distribute at least 90% of their income to shareholders as dividends. This is the easiest way to get your money invested in real estate, without having to physically own, see, or manage a property.

When building a dividend portfolio, consider dollar-cost averaging by investing a set amount regularly. With patience and consistent contributions, you can benefit from compound interest and grow your investments substantially over time.

Monthly Contribution

I’ve been in the habit of investing at minimum of $500 per month since 2019. It’s a flat number that’s comfortable for me. The $500 could be spread throughout whatever type of account of my choosing by the way, including pretax 401k contributions.

Start with a number that’s small enough for you and is comfortable. Don’t overstrain yourself right away trying to tuck away huge amounts of your check. Start small and progressively up the number from there as time goes on and as you get more into the habit of saving & investing.

You can track all of your progress with Empower.

Cash Flow Will Grow With Consistency

My $500 per month contributions eventually turned into over $500 per month being paid to me in dividends. That’s extra cash being paid to me monthly and I am free to use it however I’d like. Wouldn’t you like an extra $500 a month to put towards groceries, entertainment, your travel fund, or whatever else your heart desires?

This is my current reality because of consistency and discipline to keep investing my money, even when the market goes through a rough period. This is known as Dollar Cost Averaging.

Now be aware, starting fresh will not yield the same results as me. I am simply showing you an example of where I stand now with my dividend cash flow. Starting out, you will make smaller amounts less than a dollar at times. The math is simple though, the more you invest, the more you earn.

Well-known “safe” stocks like Pepsi pay roughly 3% annually.

Let’s do basic math.

$1,000 invested, yielding 3%, results in $30 in dividends paid to you over the year. $30 is nothing ground-breaking, but take a minute to realize that you didn’t have to do anything or talk to anyone for that money to be paid to you.

There are even solid index funds that pay a decent yield and create a passive income stream. so how do you earn passive income with dividends with the least amount of stress and risk?

Simple. There are plenty of Dividend focused ETFs out there that do a great job at providing a steady cash stream as well as price growth over the years.

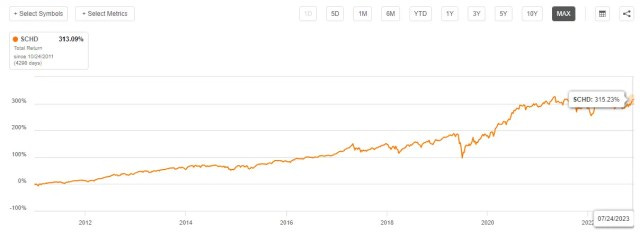

Just checkout community favorite ETF: (SCHD) Schwab U.S. Dividend Equity ETF. Currently yielding over 3.4% and has a great historical return. SCHD has returned over 300% over the last ten years including dividends.

Diversity

An important aspect of investing if making sure that all of your money isn’t only invested in one area. Now, index funds can take of this pretty easily as a lot of them are actively managed and very diverse in nature. When it comes down to your income though, you shouldn’t leave it vulnerable by investing everything into one industry.

For example, it would be a good idea to make sure your dividend income is being pulled from different places.

Get a little cash flow from the average groceries consumer by investing in Kroger or Costco.

Maybe get a little cash flow from the healthcare sector since we are all familiar with how rapidly healthcare costs are rising.

Collect your dividends from REITs (Real Estate Investment Trusts).

Collect some income from financial lending firms. Starting to get the idea?

Conclusion

In conclusion, dividend stocks, often overshadowed by their more glamorous counterparts – growth stocks, provide investors with a less flashy yet steady and dependable path to long-term wealth accumulation and a reliable stream of passive income. While growth stocks tend to garner more attention due to their potential for rapid appreciation in value, dividend stocks offer a unique set of advantages that appeal to a different segment of investors.

Use Free Financial Tools Available To You

One of the key attractions of dividend stocks is the regular income they generate. By investing in dividend-paying companies, investors can receive a portion of the company’s profits in the form of dividends. These dividends can be an essential component of one’s investment strategy, especially for those seeking a consistent income stream in addition to potential capital appreciation. For retirees or individuals nearing retirement age, dividend stocks can be particularly attractive as they provide a reliable source of income to support their financial needs in retirement.

Moreover, dividend stocks can also provide a cushion against inflation. As companies adjust their dividends over time to keep up with inflation, investors can maintain the purchasing power of their income. Unlike fixed-income investments such as bonds, which may offer a fixed interest rate, dividends have the potential to increase over the years, providing a hedge against rising living costs.

In summary, dividend stocks may not always grab headlines, but they play a critical role in a well-rounded investment strategy. They offer the potential for long-term wealth accumulation, a reliable stream of passive income, stability in turbulent market conditions, and the benefit of compounding growth. By constructing a diversified portfolio of quality dividend-paying companies, investors can work towards achieving their financial goals and securing a prosperous retirement with dividends as a dependable income source