I Analyzed 10 Option Income ETFs So You Don’t Have To

10 Income Funds That Could Pay Your Bills Every Month

The explosion of option income ETFs has created a gold rush for yield-hungry investors. With the promise of monthly payouts, sky high yields, and hands off management, these funds sound like the perfect solution for anyone trying to build passive income.

But here is the problem

Not all of these ETFs are created equally. Some are cash machines. Others are ticking time bombs.

Many investors jump in chasing the headline yield without understanding how these funds actually work. Under the surface, you will find a wide variety of strategies. Some funds hold real assets. Some track indexes. Some go all in on synthetic exposure. Each one comes with tradeoffs in yield, stability, and sustainability.

So I decided to break them down. One by one

In this post, I analyzed 10 of the most talked about option income ETFs. These include funds from YieldMax, Roundhill, REX FANG, Goldman Sachs, and JPMorgan. I ranked them by income potential, risk profile, and long term resilience.

This is not just about dividends. It is about what is driving them.

By the end of this post, you will know

Which ETFs hold real assets and which do not

Where the yield actually comes from

What risks most investors overlook

Which funds I trust enough to keep holding

How I would build a reliable income stream using the best ones

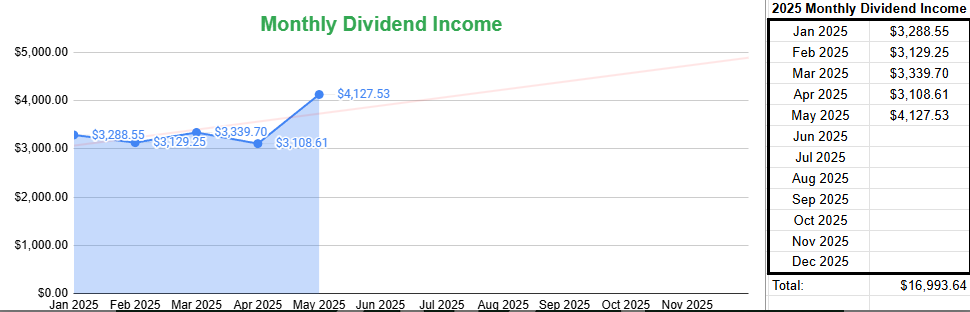

I was able to utilize these funds in a strategic way that helped me generate over $4,100 in dividend income for May. You can see that full report below. I publish all of my reports and list out what funds or stocks paid me.

May 2025 Dividend Report

When I graduated college, my first job paid me about $3,000 a month. I worked full-time, sat in traffic, juggled deadlines, and waited two weeks for each paycheck to hit.

Three Strategy Types You Need to Understand First

Before diving into each fund, it is important to understand that option income ETFs fall into three very different strategy buckets. Each has its own risk profile, payout mechanics, and behavior in different market conditions.

Some of these funds hold actual stocks. Others simply track indexes. And a few rely entirely on synthetic exposure. Knowing what strategy you are buying into is critical if you want your income stream to last.

📊 Tool: Track Your Progress

Want to keep track of what you're earning, how much your portfolio yields, and where to reinvest?

📥 Dividend Tracker Template – $5

Simple, powerful Google Sheet to track your holdings, income, yield-on-cost, reinvestment, and more.

📘 Full System: Go From $0 to $500/Month in Income

If you’re ready to build a scalable dividend income portfolio from scratch, with real structure, strategy, and support. You can start here:

🚀 The Dividend Income Blueprint – $25

My complete guide that shows how I built over $3,000/month in passive income using a three-layer dividend system, reinvestment strategy, and sustainable yield portfolio design.

Here is a breakdown of each strategy group and which funds fall under them.

Keep reading with a 7-day free trial

Subscribe to Dividendomics to keep reading this post and get 7 days of free access to the full post archives.