I watch the markets daily and have over 150 different tickers that I am constantly watching, reading analyses on, assessing earnings, and looking at valuations for. Here are some of the long term positions I will start accumulating over 2025. I plan to update this on a monthly basis and occasionally release some company specific analysis articles for you.

Believe it or not, there are still plenty of deals right now in the market despite all of the popular names trading at massive valuations. I typically invest a minimum of $1,000 per month and spread the capital across all of my holdings how I see fit. Sometimes it goes all into one stock, while other times it is evenly spread across many.

Positions I Have Already Added To

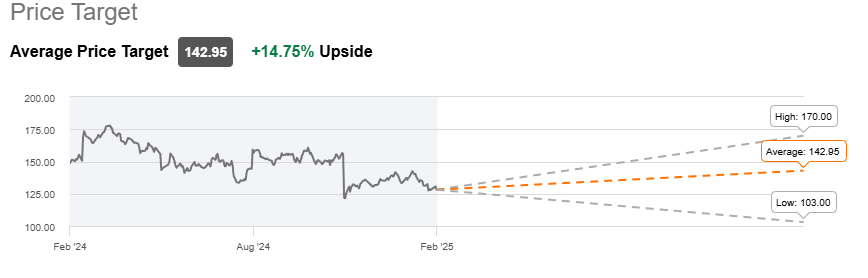

Target (TGT): Sits at new lows and I initiate a small position of about 10 shares. I am aiming for at least 100 shares and will continue to accumulate as long as the price remains below $150 per share. Wall St has an average price target of $143 per share, indicating a near 15% upside from here. However, I am more optimistic on the outlook. When interest rates start to come down and inflation cools, consumer retail spending will inevitably increase. This is a long term play and I have no sell date in mind.

Target also has an insane track record with its dividend increases. 56 consecutive increases with no dividend cuts and a safe payout ratio below 50%. Additionally, it has been able to increase its dividend at a double digit average over the last five years.

Qualcomm (QCOM): the company has strong free cash flow growth, which will likely materialize into future growth in valuation as this capital is reinvested back into the business. Even if the growth is slower than the rest of the hottest AI-related stocks, the dividend growth has been immaculate and makes this a great long term holding. The company has A-ratings across the board with an ultra-safe payout ratio and 21 years of consecutive dividend growth. QCOM has averaged a 5Y dividend CAGR (compound annual growth rate) above 6%. That’s like getting a 6% raise from your job every single year.

The next two stocks are income focused holdings.

Keep reading with a 7-day free trial

Subscribe to Dividendomics to keep reading this post and get 7 days of free access to the full post archives.