In the complex world of financial decision-making, individuals often find themselves confronted by daunting challenges. The middle-class, in particular, encounters distinct hurdles that can hinder their path to wealth accumulation. From pursuing potentially unrewarding academic endeavors to succumbing to societal pressure to live extravagantly, various financial traps can pose significant setbacks. The reality is that there is no more middle class and the gap between rich and poor will continue widening. The majority of the population don’t understand the philosophy of wealth.

Check out this cool calculator I found and see where you stand on an income basis.

High-Cost Degrees

Education is often seen as a gateway to a brighter career and financial future. However, not all educational investments yield returns that justify the substantial debt incurred through student loans. In an era where certain degrees no longer guarantee high-paying jobs, many graduates are burdened by enormous student loan debts and meager incomes that barely cover monthly repayments.

For instance, imagine a student passionate about art who accumulates over $100,000 in student loan debt to earn a degree, only to find that the best available jobs offer a yearly salary of around $35,000. This situation can quickly become a long-lasting financial burden. Hence, it is crucial to carefully assess the potential return on investment when considering a degree.

Frustratingly enough, I know a handful of people who fall into this exact trap and their solution is to always go back to school…AGAIN. They accumulate even more debt with the hope to somehow land a higher paying job. It just doesn’t make sense so please avoid this at all costs. Starting your adult life off with $100k of debt makes it very difficult to get your footing on chipping away at the debt.

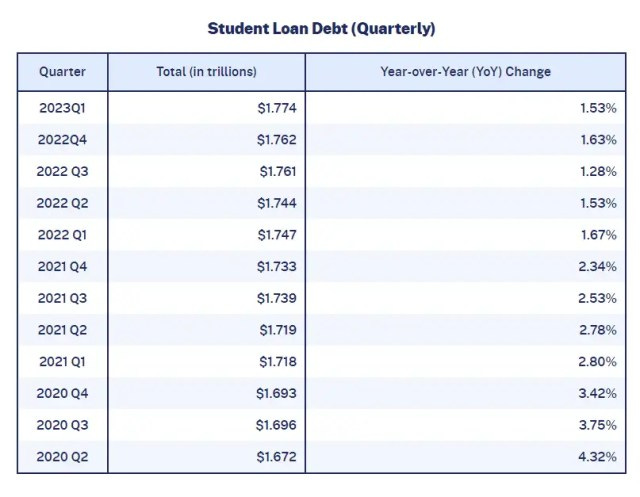

Did you know there’s currently $1.8 TRILLION worth of student loan debt?

New Car Loans

The allure of owning a brand-new vehicle is undeniable, but it often leads to a financial trap. New cars depreciate rapidly, losing up to 30% of their value in the first year alone. When coupled with financing through a loan, individuals may find themselves owing more than the car’s depreciated value – a situation known as being “upside down” on the loan. When the car’s value declines faster than the loan balance, borrowers can find themselves in a situation where they owe more on the loan than the car is worth. This is commonly referred to as being “upside down” on the loan.

Financing a new car purchase typically involves paying interest on the loan amount. Depending on the borrower’s creditworthiness and the loan terms, this interest can add a substantial cost to the overall price of the car. In some cases, the interest paid on a new car loan can significantly outweigh the car’s depreciation in value. New car loans often come with relatively high monthly payments due to the higher initial cost of new vehicles and interest expenses. These payments can strain an individual’s monthly budget and reduce their ability to save or invest for other financial goals.

The average car payment is now an insane $725 per month

Overextending with Unaffordable Mortgages

Owning a home is a common aspiration, symbolizing middle-class status and a solid investment. However, taking on a mortgage that strains one’s financial capabilities can result in significant stress and the risk of foreclosure in the face of unexpected expenses or loss of income. One of the most common mortgage pitfalls is overextending financially by buying a home that stretches one’s budget to the limit. This can happen when individuals purchase homes with large mortgages and high monthly payments, leaving little room for unexpected expenses or other financial goals. Over time, this can lead to financial stress and even foreclosure if circumstances change, such as job loss or a sudden increase in interest rates.

Mortgage interest rates can significantly impact the overall cost of homeownership. It’s important for borrowers to shop around for competitive interest rates and consider factors like fixed-rate versus adjustable-rate mortgages. A small difference in interest rates can translate into substantial savings or costs over the life of the loan.

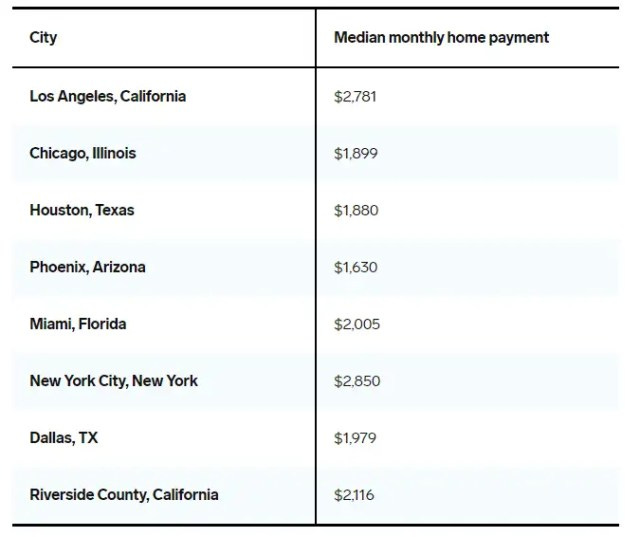

The average mortgage payment is now $2,823 per month. See the averages here.

Relying on Credit Cards

Credit cards can be a useful tool for managing short-term financial emergencies, but they can also lead to persistent debt when used to cover household budget shortfalls. Accumulated balances, combined with high-interest rates, can spiral into seemingly insurmountable debt.

Don’t be fooled by all the fancy reward and point systems. These programs are usually not worth it and require you to spend a substantial amount of money to get a small slice back in the form of a “reward”. The average credit card debt per individual is roughly $7k and the average interest rate on that debt sits around 24%.

Social Media: Keeping Up with the Kardashians

Societal pressure frequently drives people to emulate the lifestyles and spending habits of their peers, leading to excessive consumption of unnecessary items and services. This pattern, known as “keeping up with the Joneses,” can result in unnecessary debt and a cycle of overspending that hinders wealth accumulation.

By being aware of these financial pitfalls and making informed decisions, individuals can better navigate the challenges on their path to financial stability and wealth accumulation.

Social media platforms are filled with carefully curated images and posts that showcase the highlights of people’s lives, including their possessions, experiences, and vacations. Users often compare their own lives to these idealized representations, leading to feelings of inadequacy and the fear of missing out (FOMO). To keep up with the perceived lifestyles of their peers, individuals may feel compelled to spend on similar items and experiences, even if they can’t afford them.