REITs — Real Estate Investment Trusts

Real Estate Investment Trusts, or REITs, have steadily gained popularity as a compelling investment option over the years. These unique investment vehicles offer a host of benefits that make them an attractive choice for both novice and seasoned investors. In this article, we will explore the advantages of investing in REITs and delve into some historical data to highlight their potential for wealth generation.

The Benefits of Investing in REITs

Diversification in Real Estate: One of the primary benefits of investing in REITs is the opportunity for diversification within the real estate market. REITs pool funds from multiple investors to invest in various real estate properties, including residential, commercial, and industrial. This diversification can help mitigate risks associated with a single real estate investment.

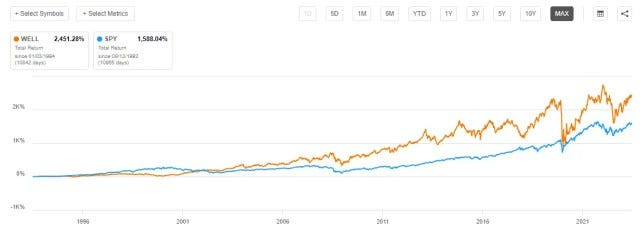

A study found that REITs actually outperform the S&P 500 Index

High Dividend Yields

REITs are required by law to distribute at least 90% of their taxable income to shareholders in the form of dividends. This results in relatively high dividend yields compared to many other investment options. For income-focused investors, REITs can provide a consistent stream of cash flow.

We’ve recently talked about our investment in Arbor Realty — An mREIT that yields us over 14% since our original purchase. This is strong cash flow that provides us with serious bill-paying power. You will never get this kind of income from a basic S&P 500 index fund. In fact, we prefer a combination of individual dividend stocks, REITs, and more rather than index funds.

Liquidity

Unlike owning physical real estate properties, investing in REITs offers liquidity. You can buy and sell REIT shares on major stock exchanges, providing flexibility to adjust your portfolio according to your investment goals.

REITs are managed by experienced professionals who handle property selection, maintenance, and leasing. This allows investors to benefit from the expertise of real estate specialists without the hassle of hands-on property management.

It’s super easy to get your hands on some shares of these. If you don’t already have a brokerage account, we recommend heading over to our money tools and taking a look on where you can get started. Buying shares of REITs are super liquid: this means that you can access your invested cash almost instantly by selling and transferring the proceeds from your brokerage account to your bank account.

Potential for Capital Appreciation

In addition to dividend income, REITs can also appreciate in value over time. As real estate properties within the portfolio appreciate, the value of the underlying REIT shares may increase, offering potential capital gains.

Appreciation can happen in 3 ways, all of which require no action from you as a shareholder.

Property Appreciation: As the properties owned by the REIT appreciate due to market dynamics, renovations, or location desirability, the overall value of the REIT’s assets increases.

Market Demand: Increased demand for specific types of real estate, such as residential or commercial properties, can drive up the value of the REIT’s holdings.

Economic Growth: A strong economy often results in increased property values and higher occupancy rates, positively impacting the performance of REITs.

While capital appreciation potential is an attractive feature of REITs, it’s important to note that not all REITs will experience significant price gains, and past performance does not guarantee future results. Investors should carefully consider factors such as the quality of the REIT’s portfolio, market conditions, and overall economic health when assessing their potential for capital appreciation.

Historical Data on REIT Performance

Steady Growth Over the Years: Historical data reveals that REITs have shown consistent growth over the past few decades. According to the National Association of Real Estate Investment Trusts (NAREIT), the FTSE NAREIT All Equity REITs Index delivered an annualized total return of approximately 11.9% from 1972 through 2020.

We also have data that they display higher resilience during economic downturns. During the 2008 financial crisis, while many asset classes suffered significant losses, REITs proved to be more resilient due to their income-producing nature. Even if the value of the underlying asset falls, the cash flow being received makes the psychology of holding a lot easier to do.

Real estate investment trusts have historically offered attractive income generation. In 2020, the average dividend yield for equity REITs was approximately 3.7%, providing investors with a steady income stream even in challenging economic environments.

Potential for Portfolio Diversification

Historical data also highlights that including REITs in a diversified investment portfolio can enhance risk-adjusted returns. The low correlation between REITs and traditional asset classes, such as stocks and bonds, can help reduce overall portfolio volatility.

Asset Variety: REITs invest in various types of real estate, including residential, commercial, industrial, healthcare, and more. By holding shares in a REIT, you effectively own a piece of this diversified real estate portfolio. This variety reduces the risk associated with a concentrated investment in a single property type.

Geographical Diversification: REITs often hold properties in different geographic locations, both domestically and internationally. This geographic diversification helps shield your investment from regional economic downturns or local real estate market fluctuations.

Tenant Diversification: Many REITs lease their properties to multiple tenants. This diversity of tenants, often spanning various industries, can help stabilize rental income. Even if one tenant faces financial difficulties, the impact on the overall REIT’s income may be less pronounced.

Property Size and Class: REITs may own a mix of properties in terms of size and class. Some may focus on large, Class A office buildings, while others invest in smaller, Class B or Class C properties. This diversity allows investors to choose REITs that align with their risk tolerance and investment goals.

One of the stocks we highlighted as previously outperforming index funds was Welltower (WELL), a healthcare REIT. This is just one example of the type of diversity offered by this asset class.

Conclusion

Real Estate Investment Trusts offer a compelling blend of income generation, potential for capital appreciation, and diversification benefits. Their historical performance data underscores their ability to weather economic storms and provide consistent returns over the years. However, as with any investment, it’s essential to conduct thorough research, assess your financial goals, and consult with a financial advisor to determine if REITs align with your investment strategy. With careful consideration, investing in this asset class can be a key step toward building long-term wealth and financial security. By incorporating real estate exposure into your investment strategy, you can potentially achieve a more balanced and resilient portfolio that positions you well for the future.