The Money Playbook To Get Your Finances Straight

Building Wealth Is Super Simple, It Just Isn't Easy.

Some people put this taboo around money that makes it such an uncomfortable topic of conversation for most. I always found it strange that talking about money wasn’t embraced by the same people that would openly discuss drugs, sex, and gossip. As I’ve grown older I’ve come to learn that people’s hesitation to talk about money usually comes from the lack of money. Sticking to the facts here, most people are broke. There are over 36M people in the US that are living under the poverty line.

I can site a plethora of different studies and surveys that reinforce the idea that people simply do not have enough money to their name. While there are definitely complex systems at play that contribute to people’s lack of money, there is one that always seems to be skipped over. Lack of accountability. Accountability for their bad choices and lack of effort. Before you get triggered, hear me out. I understand that there are certain roadblocks in life and everyone gets dealt a different hand.

But so what? Boo Hoo. How long are you going to let that continue to stop you?

How many people do you know that always have the newest and shiniest shit? People that make less money than you but drive a nicer car? People that stay in shitty jobs because it’s easier to tolerate it instead of putting yourself out there to interview with other companies. People that bitch and moan about the price of groceries and the price of gas, but they continue to get the latest iPhone every single year. People that take it a step further and finance entire vacations on a fucking credit card so they can get their beloved ‘points’. Meanwhile, they put no effort into building a next egg for themselves because they haven’t built the muscles in their body that allow for delayed gratification.

Delayed gratification will lead to stupid financial decisions that set you back. Wealth building is simply a math equation and too many people act as if they are incapable of throwing some numbers on a napkin to see if it makes sense. Wealth building is extremely simple but it just isn’t. If you ‘aren’t good with money’ stop bullshitting and put it in the effort it takes to get good.

You mean to tell me you know the difference between every star sign, know the personal lives of actors you’ll never meet, watch every football game on Sunday, but you can’t put in 15 minutes to watch a Youtube video on basic financial habits that affect your personal life?

Let me make it simple for you and lay it out.

Step 1: Assess Your Financial Situation

Begin by gaining a clear understanding of your current financial standing:

Track Income and Expenses: Document all sources of income and categorize your monthly expenses. This practice helps identify spending patterns and areas where you can cut back.

Set Financial Goals: Determine both short-term and long-term financial objectives to provide direction and motivation for your financial planning.

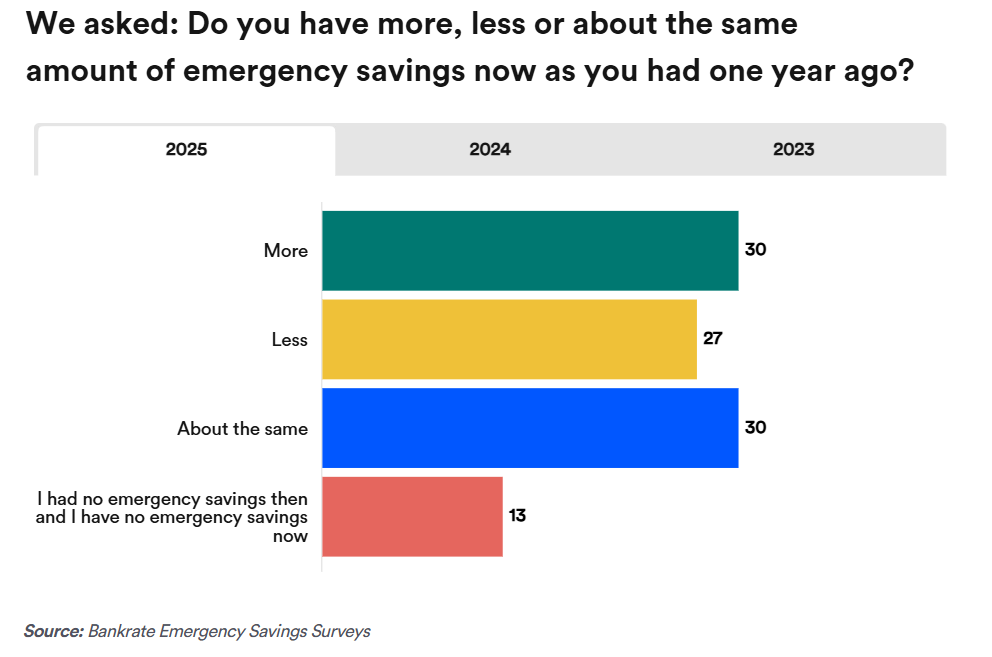

Step 2: Build an Emergency Fund

An emergency fund acts as a financial safety net for unexpected expenses:

Start Small: Aim to save at least $5,000 initially to cover minor emergencies.

Expand Over Time: Gradually increase your savings to cover three to six months' worth of essential living expenses, adjusting based on your personal circumstances and job stability.

Step 3: Address High-Interest Debt

Reducing high-interest debt is crucial to prevent interest from eroding your financial progress:

Prioritize Debts: Focus on paying off debts with the highest interest rates first, such as credit card balances.

Consider Strategies: Utilize methods like the debt snowball (paying off smallest debts first) or debt avalanche (tackling highest interest debts first) to systematically reduce debt.

Step 4: Maximize Employer Benefits

Take full advantage of benefits offered by your employer to enhance your financial well-being:

Employer Retirement Match: Contribute enough to your retirement plan (e.g., 401(k)) to receive the full employer match, effectively securing free money for your future.

Health Savings Accounts (HSAs): If eligible, contribute to an HSA for tax-advantaged savings on medical expenses.

Step 5: Invest for the Future

Once you've stabilized your immediate finances, focus on long-term growth:

Retirement Accounts: Maximize contributions to tax-advantaged accounts like IRAs and 401(k)s.

Diversify Investments: Consider a mix of stocks, bonds, and other assets aligned with your risk tolerance and financial goals.

I already discussed how we are using debt to generate massive levels of monthly income. Building wealth is as easy as choosing to get on the other side of the cash register.

Series: Building A Second Income Stream (Part 1)

This has to be the best time in modern history to be an income investor. There are so many different tools at our disposal that make it incredible simple to increase our income, wealth, and financial security. I wanted to share the foundation of a new

Thanks for reading. Keep an eye out on the continued series on how I am using debt to generate massive levels of income.