This Fund Has Paid A Double-Digit Dividend For Nearly 2 Decades

It's entirely possible to collect a sustainable 13% dividend yield.

Most people have no idea that you can collect a double digit dividend yield over a long period of time. I’d argue that a lot of people don’t even know what a dividend is. If you’re reading this, I’m sure you’re not one of these people. They let ignorance take over and they accept a measly 0.1% interest rate on their cash in a savings account. This is a recipe to work at a meaningless job and then depend on social security to fund your retirement. Or you can take matters into your own hands and fuel your own retirement by allowing your dollars to work for you. Today I will share a fund that has paid out the same double-digit dividend yield for nearly two decades and currently has a dividend yield over 13%.

Guggenheim Strategic Opportunities Fund (GOF) operates as a closed end fund that aims to generate attractive total returns from its portfolio of different debt investments. I pulled the portfolio breakdown directly from the fund’s overview page. As a starting point, I would recommend that you learn the differences between each one of these categories before you even consider blindly buying into a fund like this. We can see that the combination of bank loans and high yield corporate bonds make up the majority of the assets. By investing in GOF you are also getting some exposure to asset-backed securities, such as residential and commercial properties. GOF essentially invests into different categories of debt and receives interest, equity, realized gains, and dividends in exchange, which it then uses to pay to investors.

I put together analyses like this all of the time. If you are interest, please consider subscribing. These are the funds that Wall St doesn’t want you to know about.

Now, let’s measure the true performance over the fund’s inception and what you should expect going forward.

Most people will look at the price chart and question why in the world anyone would invest into a fund that has lost 20% of its value over two decades. Exclusively looking at the price change would be their first mistake. The current dividend is nearly 13.8%, meaning that a $10,000 investment will generate you $1,380 annually.

A $100,000 investment would generate you $13,800 annually in passive income.

In order to properly assess fund’s like this, we have to include all dividends that were paid out to shareholders. If you were to invest in this fund at its inception, you would have received a total return over 466%. When you look at it from this perspective, who really cares about a price drop? A $10,000 investment would now be ‘valued’ at $7,250 BUT you would have collected over $46,000 back in dividends over this time span. Can you really consider this a bad investment? Would you have been better off with a more traditional ETF? Maybe, depending on your situation but let’s remember that GOF should be utilized as an income fund.

GOF has one of the most consistent distribution histories over time as well. Looking at the dividend history chart below, we can see that the dividend has remained exactly the same since 2013 and has avoided any cuts or disruptions. This means that your dividend income would have remained steady through market declines, through recessions, through president changes, and any other factor that causes market uncertainty. While the rest of the market is panicking, you can sit back and relax the steady income. An added bonus is that GOF pays out its distributions on a monthly basis.

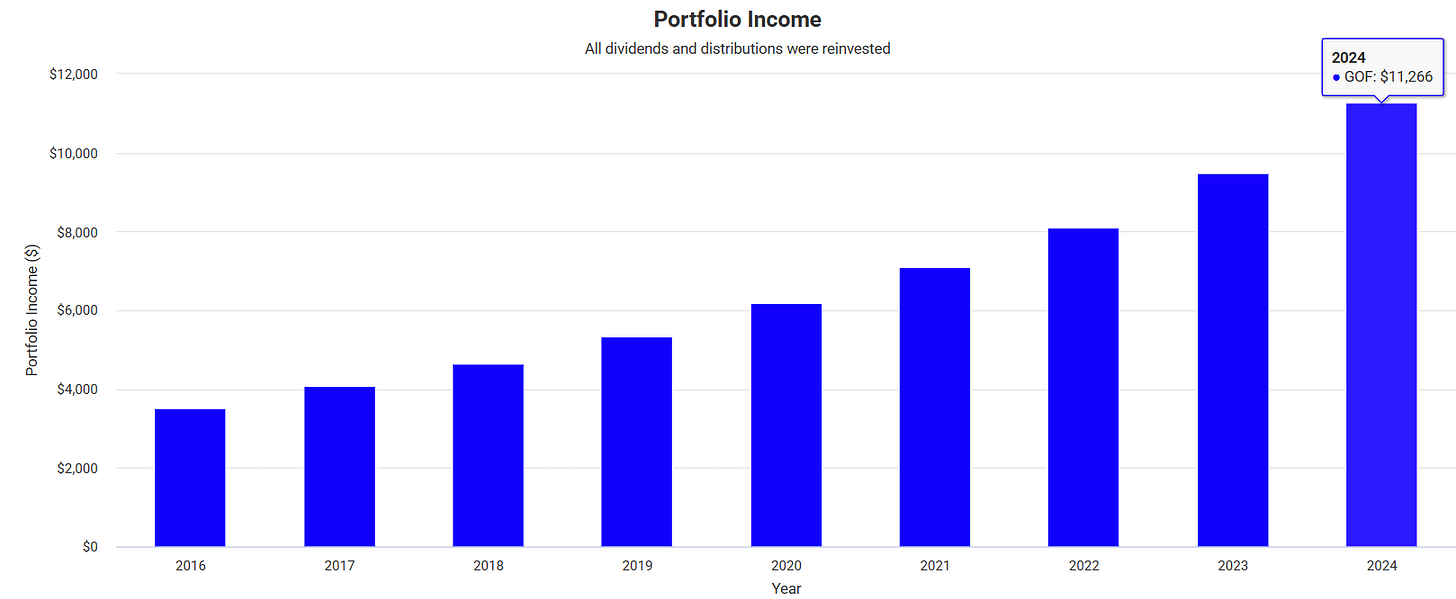

The consistent payouts mean that you can gradually grow your dividend income over time from adding more capital and reinvesting portions of your dividend income back into GOF. For instance, let’s assume an original investment of $25,000 at the start of 2016. Let’s also assume that you added $100 into GOF every single month throughout the entire holding period. Your dividend income would have grown substantially, despite the lack of raises.

2016 Dividend Income: $3,517

2024 Dividend Income: $11,266

GOF generates the income it needs through its diverse range of debt investments.

The problem?

Well, these investments are typically to borrowers that have poor credit ratings. For reference, anything rated below a BBB is typically considered to be ‘junk debt’. According to the breakdown below, over half of the fund is allocated to these below investment-grade borrowers. Only about 37% of the fund is allocated towards healthy-rated debt with a grade of BBB and above.

The issue comes from the currently high interest rate environment. A higher interest rate is directly associated to a higher cost of borrowing. As a result, borrowers need to dish out more capital towards interest expenses on any debts they have. A higher cost of debt can chew into a borrowers operating margin and can lead to an increased rate of defaults within GOF’s portfolio. However, I would anticipate interest rates to get cut by 2026 so that could provide some relief to borrowers. Looking at the chart below, we can see how GOF’s price shares an inverse relationship with the current interest rate environment. As rates were increased, GOF’s price has fallen. As rates were near zero, GOF’s price rapidly moved up in 2020 and 2021.

I have personally held a position in GOF since 2020 and have been happy with the consistent income. An added bonus is that most of the distributions are considered to be ‘return of capital’. Return of capital dividends have no direct tax consequences, but your cost basis is reduced and taxes are deferred until the time of sale. However, I do not plan to sell this fund.

Thanks for reading! I’ve love to hear your thoughts! If you found this helpful, consider sharing this on your feed!