Why Most ETFs Keep You Average & The Two Stocks I’m Buying That Could Change Everything

There are two stocks that still remain undervalued. I am adding to these to outperform the S&P 500.

Most investors proudly say they’re “indexing.” They buy ETFs that track the S&P 500 or the total U.S. stock market and assume they’re making the smartest, most rational choice. And for many, it is better than speculating on individual stocks.

But there’s a truth few talk about: most ETFs are built to keep you average. That’s not an accident. It’s literally their design. They mirror the market’s movements, but they’re not engineered to outperform it. When you dig deeper, you’ll realize that even passive investing has built-in flaws and if your goal is to generate outsized returns, meaningful income, or financial freedom on your terms, staying average might not cut it.

The reality? You need to take risks in order outperform. Stop being a little bitch and trust yourself. You are capable of doing the proper investment research needed to find those gems. Put in the work: read through earnings reports, listen to earnings calls, google the financial metrics you need to understand and take it from there.

Now don’t get me wrong. If you prefer to take the index fund route, then do that. But by taking the index fund route, you are eliminating the possibility for large gains.

The Hidden Flaw of Market Cap Weighting

The majority of ETFs, including staples like SPY 0.00%↑, VTI 0.00%↑, and QQQ 0.00%↑, use market capitalization weighting. This means the larger a company’s value, the more of that company the ETF owns. If Apple AAPL 0.00%↑, Microsoft MSFT 0.00%↑, or Nvidia NVDA 0.00%↑ increase in market value, the ETF automatically increases its exposure. If a smaller company drops in size, the fund holds less of it or excludes it altogether.

This automatic buying of winners and shrinking of losers sounds efficient. But it also means you’re buying high and selling low, every time. You’re not making decisions based on value, fundamentals, or future prospects. You’re just following momentum. In strong bull markets, this can work out well. But when leadership shifts or a large tech name stumbles, your exposure can quickly become a liability.

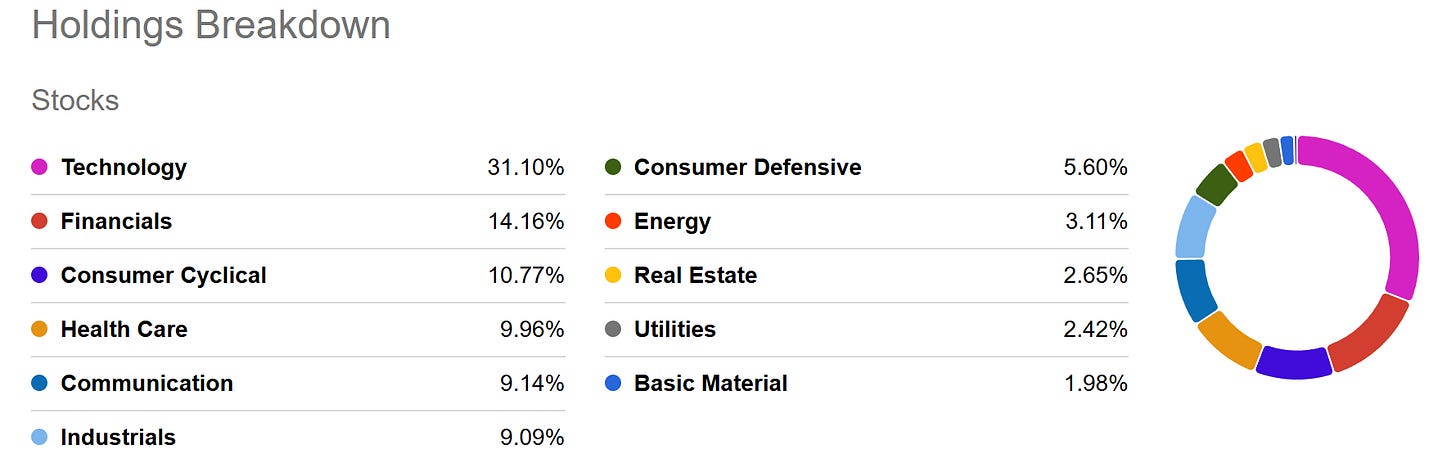

Market cap weighting disguises itself as diversified investing, when in reality, it’s just concentration in disguise. For instance, Vanguard Total Stock Market Index Fund ETF Shares (VTI), has over 3,500 positions within. However, the top ten positions account for over 31% of the entire fund, which means these companies have the largest impact on VTI’s returns. So a fund like VTI is filled with a bunch of fluff that isn’t really adding any value to your portfolio.

Diversification Isn’t What You Think It Is

Ask most investors why they hold VTI, and they’ll say it’s for diversification. After all, the ETF holds over 3,500 stocks. That sounds like safety. But since the top 10 companies in VTI drive a disproportionate share of its performance, you are getting a false sense of diversification. If those names rise, your portfolio rides along. If they stall or fall, everything else does too. This isn’t true diversification. It’s duplicated exposure spread across multiple tickers with different labels.

Real diversification involves spreading across different strategies, asset classes, and risk profiles, not just stock count.

Fortunately, not all ETFs are built the same. There’s a growing class of smarter, rules-based ETFs that weight companies by factors like dividends, profitability, volatility, or financial quality rather than just size. These funds aim to extract more meaningful results from the index by selecting or weighting companies that demonstrate consistent performance traits.

For example, SCHD 0.00%↑ focuses on companies with strong dividend histories, sustainable earnings, and solid balance sheets. RSP 0.00%↑ takes a different approach by equally weighting all S&P 500 constituents, giving you broader exposure to more names without overloading on mega caps. QUAL 0.00%↑ looks for firms with high returns on equity and strong financials, while USMV targets companies with historically lower price volatility for smoother returns.

These ETFs don’t try to chase momentum. They build around structural advantages. And that small shift in weighting strategy can make a large difference over time.

What I Do Instead

I still use ETFs but not the traditional way. I’ve built a portfolio system that treats ETFs like components in a machine, each with a specific job. My priority is income, growth, and speed of compounding. That means using ETFs that do more than just track the market.

For income, I lean into high-yield, weekly-paying ETFs like QDTY 0.00%↑, XDTE 0.00%↑, and YMAX 0.00%↑. These funds generate substantial cash flow through covered call strategies and 0DTE options. While they may not provide long-term capital appreciation, they serve as powerful cash flow engines. I use that income to pay down margin, fund reinvestments, and channel those dividends back into growth positions that are known to outperform.

For instance, I collected about ~$775 in dividends last week and used this to build positions back into some growth positions.

Then I funnel the excess income into long-term growth positions. For instance, here are some of the things I am buying and believe to be undervalued at the moment:

Alphabet GOOG 0.00%↑

Google: Why I'm Adding $20K To This Stock

Alphabet Inc. is far more than just a search engine giant. While its advertising business remains a formidable cash cow, the company is actively cultivating multiple, high-growth ventures that are poised to redefine its future and offer substantial upside for investors. From its pioneering efforts in autonomous driving to its advancements in artificia…

ASML Holdings ASML 0.00%↑

Equifax EFX 0.00%↑

PepsiCo PEP 0.00%↑

Target TGT 0.00%↑

I allocate this capital towards high conviction holdings that are designed to build wealth over time. I selectively use margin as a way to accelerate ownership. There’s no maturity date, and as long as the yield I collect outpaces the interest I pay, I’m increasing the equity in my portfolio. That loop of income → reinvestment → growth makes my system compound faster than a traditional buy-and-hold ETF basket.

And I’m not bullshitting here. I share screenshots of everything. Take a look at my portfolio’s performance over the last twelve months compared to the market indexes.

And if there’s a period of time where I cannot locate an attractive opportunity in the market, I throw the cash into Invesco Nasdaq-100 ETF QQQM 0.00%↑.

I call this the Dividend Wheel Strategy and I’ve covered this concept recently. I would suggest readers go back and check that out.

The Dividend Wheel Strategy: Using High-Yield ETFs to Buy Growth for Free

Stop choosing between yield and growth. This strategy gives you both.

So what am I buying next? Well, I believe these companies to still be undervalued and will be able to benefit from the growth of AI:

Also, I am adding another company that is one of the most innovative companies in the world right now, and it’s not a company that you’d expect.

Keep reading with a 7-day free trial

Subscribe to Dividendomics to keep reading this post and get 7 days of free access to the full post archives.