5 Monthly Paying Dividend Stocks That Provide Reliable Cash Flow

5 Monthly Paying Dividend Stocks for Consistent Portfolio Income in 2025 & Beyond

Most people invest with a long-term mindset. They build a portfolio, wait for it to grow, and hope that someday it gives them freedom. That works, but I prefer something more tangible. I want my portfolio to do something right now.

That’s why I focus on income and not just growth. And not just any income, but income that hits every single month.

While most dividend stocks pay quarterly, monthly paying stocks and funds offer a major advantage. They provide more frequent payouts, faster compounding, and smoother cash flow. Whether you're reinvesting, covering margin interest, or supplementing your lifestyle, getting paid monthly creates a rhythm that just works.

This is especially important if you're using dividends to cover real expenses or strategically manage leverage. More frequent income gives you flexibility, and flexibility is power.

1. Realty Income O 0.00%↑

Yield: ~5%

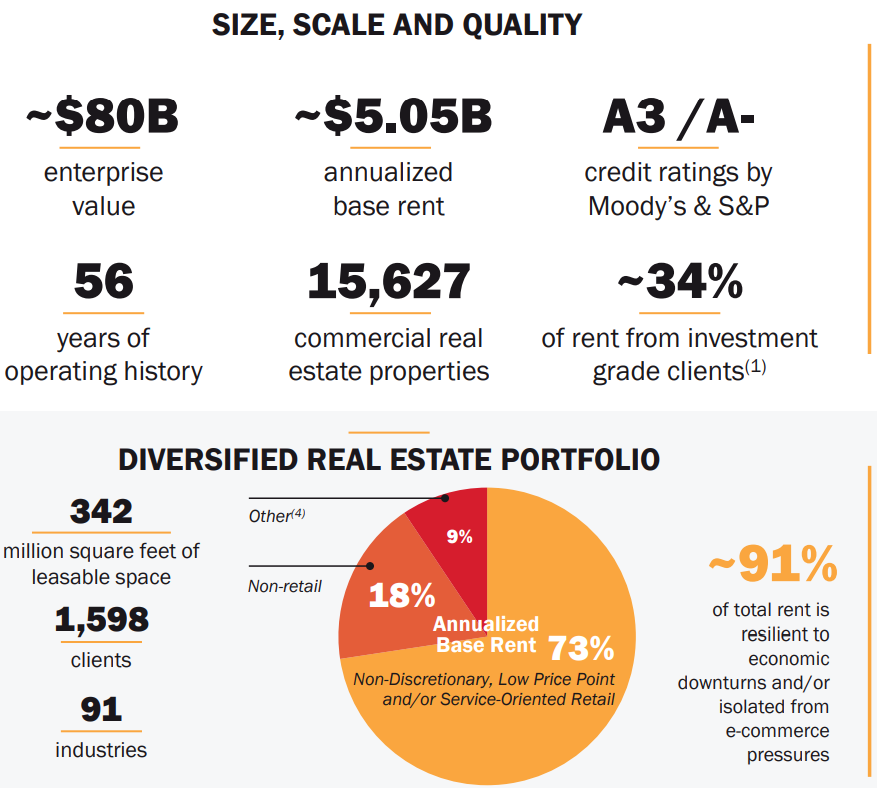

What it does: Realty Income is the most well-known monthly dividend stock on the market. It is a real estate investment trust (REIT) that owns a diversified portfolio of over 13,000 commercial properties across the U.S. and internationally. Its tenants include Walgreens, Dollar General, 7-Eleven, and other recession-resistant brands.

Strengths:

Monthly payout track record since 1994

Investment-grade balance sheet

Built-in rental escalations help offset inflation

Weaknesses:

Sensitive to interest rate changes

Grows slowly compared to high-yield alternatives

Heavily owned by institutions, limiting upside surprises

Why I hold it:

O gives me peace of mind. It is boring, reliable, and keeps paying through every cycle. It is a core piece of my dividend stability layer. Just for transparency sake, here are the REITs that I currently hold and plan to maintain a position in for the next decade.

2. Goldman Sachs S&P 500 Premium Income ETF GPIX 0.00%↑

Yield: ~9%

What it does: GPIX is an option income ETF from Goldman Sachs that sells covered calls on the Nasdaq 100. It is part of a newer wave of monthly paying ETFs designed to deliver high yields by monetizing volatility rather than relying on price appreciation.

Strengths:

High monthly income

Simple rules-based structure

Backed by Goldman Sachs

Weaknesses:

Distributions include return of capital

NAV can decline over time due to option-selling drag

Limited upside in strong bull markets

GPIX is a high-yield cash flow tool. I am not relying on it for long-term growth. I use it tactically, especially when using margin, to generate consistent monthly income I can redirect into my core holdings.

$396,000 Dividend Portfolio Update #1

Most people share opinions. Fewer share receipts. Today I’m opening the curtain and walking you through my actual portfolio. Every fund, every stock, every decision reflects how I’m building income, protecting downside, and positioning for long-term wealth.

3. Guggenheim Strategic Opportunities Fund GOF 0.00%↑

Yield: ~14%

What it does: GOF is a closed-end fund that invests in a mix of corporate bonds, asset-backed securities, and other income-generating credit assets. It uses leverage and option overlays to support its monthly payout.

Strengths:

Reliable monthly distributions

Diversified credit exposure

Attractive for income-focused investors

Weaknesses:

Often trades at a premium to NAV

Exposed to credit and interest rate risk

Uses leverage, which can amplify losses

Why I hold it:

GOF gives me exposure to fixed income and credit markets while still paying monthly. I do not expect major capital growth, but the yield helps me meet my income targets.

I’ve actually written about GOF before -

This Fund Has Paid A Double-Digit Dividend For Nearly 2 Decades

Most people have no idea that you can collect a double digit dividend yield over a long period of time. I’d argue that a lot of people don’t even know what a dividend is. If you’re reading this, I’m sure you’re not one of these people. They let ignorance take over and they accept a measly 0.1% interest rate on thei…

This next holding has a history of outpacing the S&P 500 in total returns.

Keep reading with a 7-day free trial

Subscribe to Dividendomics to keep reading this post and get 7 days of free access to the full post archives.