How $250 A Month Can Turn Into a Reliable Passive Income Stream

The Easiest Way to Let Time and Dividends Make You Rich

Most people overestimate what they can do in a year, and underestimate what they can build in a decade. When it comes to long term investing, consistency beats intensity. And SCHD is one of the best ETFs for consistent dividend investors who want to build real, usable income over time.

You’ve probably heard the quote.

“Compound interest is the eighth wonder of the world.”

But most people don’t realize just how powerful it really is.

So let’s break it down.

Compound interest happens when your money makes money. Then that money makes even more money. And then that new money?

It starts compounding too.

In the early years, the growth feels slow. Nothing seems exciting.

But keep going. Stay consistent. And somewhere around year 10 to 15, something wild happens.

Your account starts to grow faster than you can contribute.

The SCHD Example: Small Steps, Big Results

Let’s say you invest just 250 dollars a month into SCHD.

You do it every month. You don’t skip. You don’t chase trends. You just show up.

After 20 years, with reinvested dividends and an 11 percent dividend growth rate, your portfolio could be worth around 148,000 dollars.

But here’s the crazy part.

The annual dividend income alone could be over 37,000 dollars per year.

That’s more than half your total contributions back every single year in income.

You are not just investing. You are building a machine that prints money.

Why SCHD?

SCHD (Schwab U.S. Dividend Equity ETF) is one of the most reliable, liquid, and shareholder-friendly dividend ETFs on the market. It tracks an index of high quality U.S. companies with a strong history of paying and growing dividends. For instance, here is a list of SCHD’s top ten holdings.

What makes SCHD stand out:

It has a strong dividend yield (typically between 3 and 4 percent)

It focuses on quality and sustainability, not just high yield

It rebalances annually to stay diversified

It has a low expense ratio of just 0.06%

It pays dividends quarterly

SCHD is not designed for overnight gains. It is built for long term accumulation and reliable cash flow. That is exactly what makes it perfect for a consistent strategy like this. I wrote a really in-depth piece about SCHD that I would recommend you go back to read if this concept is interesting to you.

Why This Might Be the Greatest Dividend Growth ETF Ever Created

We are living in an era where inflation is no longer a background risk. It is front and center. While it has cooled from its 2022 peak, core inflation in the United States still hovers above the Federal Reserve’s two percent target, and many essential goods and services continue to rise in price year over year.

The Setup: $250 a Month for 20 Years

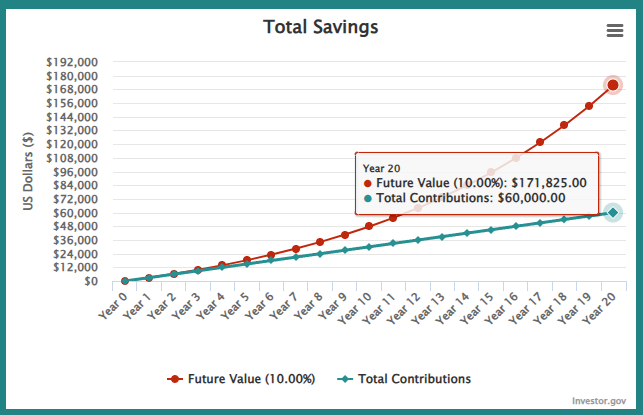

Let’s assume you start with nothing. You simply invest $250 per month, every month, into SCHD for 20 years. That is $3,000 per year or $60,000 in total contributions.

Assumptions:

Annual return of 10% (a blend of price appreciation and dividends)

Dividend yield of 3.5% on average

Dividends are reinvested automatically

By the end of 20 years:

Portfolio value: ~$172,000

Annual Dividend Income in Year 20: ~$37,692

Monthly Passive Income in Year 20: ~$3,141

This is entirely passive. It requires no trading, no timing, and no major decisions. Just a recurring investment into a reliable dividend ETF.

SCHD’s Dividend Growth Is Quietly Elite

SCHD is not just known for stability. It has quietly become one of the most powerful dividend growth ETFs in the entire market.

Let’s break it down.

SCHD has increased its dividend for 13 straight years

Its 5 year dividend growth rate is 11.44 percent

Over the past 10 years, it has grown dividends at an average of 11.3 percent per year

That kind of growth places it near the top of all dividend ETFs. Most funds do not even come close. In fact, the average ETF has a 5 year dividend growth rate of just 5.74 percent.

SCHD nearly doubles that.

Most ETFs offer one or the other. SCHD gives you both.

That means your income potential increases every year, not just from reinvestment, but from the fund raising its payouts consistently. Over time, this builds into real passive income power.

Turning the Portfolio Into Income

Once you reach the 20-year mark, you have two paths:

Keep reinvesting and let it grow larger

Turn off reinvestment and start collecting the dividends

If you choose to collect the dividends, SCHD will pay you approximately $9,423 every quarter. That is enough to cover small bills, boost retirement income, or offset living expenses.

And the longer you hold it, the more the dividend can grow. SCHD has a strong history of increasing its payout year after year. That means your passive income stream can rise even if you never add another dollar.

Why This Strategy Works

It is simple: No speculation, no market timing, just automation

It is repeatable: Anyone can start with $250 a month

It is sustainable: You are buying ownership in real businesses

It pays you: Every quarter, without needing to sell a single share

Most people chase results. But wealth is built through repetition. A strategy like this takes the emotion out of investing and replaces it with structure. You can set it up in an afternoon and forget about it until the income starts rolling in.

Here’s some homework for you - watch this video below.

Fuck Waiting 20 Years Though!

Not everyone starts with just 250 dollars a month. And the truth is, the path to financial independence can move a lot faster if you have more capital to deploy.

What happens if you invest 1,000 dollars a month? Or 5,000? What if you consistently put 10,000 dollars a month into a dividend growth strategy like SCHD?

Now you are not just building income. You are compounding wealth on a completely different scale.

When your contributions are larger, two powerful things happen.

You Buy More Time

Every extra dollar invested today saves you years later. Larger contributions shrink the timeline. What takes 20 or 30 years at lower amounts can often be achieved in a fraction of the time. You are essentially buying your freedom in advance.

Dividends Snowball Sooner

More capital means more shares. More shares mean more dividends. More dividends mean more to reinvest. It turns into a compounding loop. And when that loop starts with a bigger base, the exponential effects kick in much earlier.

Even if you only invest large amounts for a few years, the impact sticks with you forever. It is like giving your portfolio a head start that never wears off.

Final Thoughts

SCHD is not flashy. But it works.

And when paired with a consistent contribution plan, it becomes one of the most reliable tools for building dividend income over time.

Whether you are just starting or looking to create an income stream for the future, investing $250 a month into SCHD can help you build a portfolio that pays you for life.

Small steps. Long runway. Predictable outcome.

That is the power of consistent investing.

How I’d Collect $3,000 In Monthly Dividend Income From A $150K Medium-Risk Portfolio

There’s something transformative about knowing that your portfolio will pay you regardless of what the market does, how your job is going, or where interest rates stand.

📊 Tool: Track Your Progress

Want to keep track of what you're earning, how much your portfolio yields, and where to reinvest?

📥 Dividend Tracker Template – $5

Simple, powerful Google Sheet to track your holdings, income, yield-on-cost, reinvestment, and more.

📘 Full System: Go From $0 to $500/Month in Income

If you’re ready to build a scalable dividend income portfolio from scratch, with real structure, strategy, and support. You can start here:

🚀 The Dividend Income Blueprint – $25

My complete guide that shows how I built over $3,000/month in passive income using a three-layer dividend system, reinvestment strategy, and sustainable yield portfolio design.

It includes:

The strategy I use

Portfolio structure breakdown

Real examples + reinvestment tactics

Income planning + risk controls

Bonus: Checklist, glossary, & asset filters

Want to get a well-rounded idea of where to start your investing journey? I have you covered here as well!