Why This Might Be the Greatest Dividend Growth ETF Ever Created

Get A Dividend Raise Every Year From Cash Flowing Businesses

We are living in an era where inflation is no longer a background risk. It is front and center. While it has cooled from its 2022 peak, core inflation in the United States still hovers above the Federal Reserve’s two percent target, and many essential goods and services continue to rise in price year over year.

At the same time, interest rates remain elevated, with the Federal Funds Rate sitting above five percent as of mid 2025. This has created pressure on fixed income investors and added volatility across equity markets. Bonds offer yield again, but many still lag inflation after taxes. High flying tech stocks, which dominated in the low rate era, are now subject to repricing as capital becomes more expensive.

In this kind of environment, dividend growth becomes a strategic edge.

A static 3% yield may look appealing today, but if that income stream does not grow, it loses purchasing power over time. Dividend growth strategies, by contrast, help investors outpace inflation. If a stock or ETF can grow its payout by eight to twelve percent annually, as the fund we are talking about has done, then your real income is increasing each year, not shrinking.

Wage growth has struggled to keep up with inflation in many sectors, and traditional retirement withdrawal strategies, like the four percent rule, are under scrutiny in a world with more uncertainty and fewer guarantees. Dividend growth fills that gap. It delivers reliable, rising cash flow, which can be reinvested during the accumulation phase or used for lifestyle support in retirement, all while adapting to economic changes.

10 Monthly Dividend Stocks That Pay Me $1,688💸

Most investors wait every quarter to collect their dividends.

If you told most people there was an ETF that delivered nearly double digit dividend growth for over a decade, held some of the most profitable companies in the U.S., and charged just pennies in fees per one hundred dollars invested, they would assume it was a well kept secret of the ultra wealthy.

But it is not.

It is available to everyone. It trades like any other stock. And it has quietly become one of the most powerful income building machines in the market today, without hype, without headlines, and without the volatility that turns most investors into emotional wrecks.

This fund does not promise wild upside or meme level returns. What it offers is far more valuable over the long run: consistent, rising income and durable wealth.

So why does not everyone talk about it?

Because it is boring.

And in the world of investing, boring is where the real magic happens.

If you gave me just one ETF to build a dividend growth portfolio from scratch, I wouldn’t even blink. I’d pick this.

The Schwab U.S. Dividend Equity ETF has quietly become a favorite among income-focused investors and for good reason. It offers a rare blend of high-quality companies, consistent dividend growth, solid total return, and incredibly low fees.

But SCHD isn’t just “another dividend ETF.” It’s one of the most intelligently designed, shareholder-focused, wealth-building vehicles on the market.

1. SCHD Invests in Quality, Not Just Yield

Most dividend ETFs fall into one of two traps. They either chase high yields and end up with shaky companies, or they go conservative and deliver weak payouts.

SCHD threads the needle beautifully. It starts by screening for U.S. companies with a 10-year track record of dividend payments so no fly-by-night names. Then it uses fundamental factors like return on equity, dividend growth rate, and cash flow to debt to build a high-conviction portfolio of about 100 names.

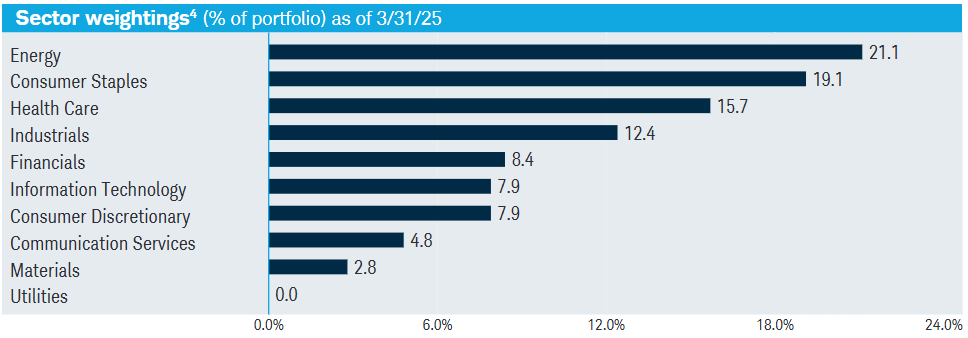

This means SCHD isn’t just a yield play. It’s a quality play. You're getting strong, shareholder-friendly companies with durable business models and financial strength. Looking at the breakdown by sector, we can see that SCHD prioritizes sectors with reliable cash flows.

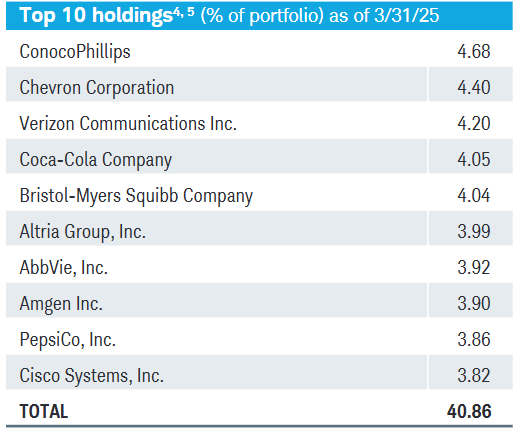

Looking at the top ten holdings, we can see a diverse mix of exposure to large-cap companies.

The holdings are rebalanced by weight every quarter and the actual stocks within are reselected during March of every year. The fund has a proven history of success compared to other dividend focused ETFs. For instance, SCHD has returned nearly 400% over the last 13 years.

2. A Growing Dividend That Actually Keeps Up With Inflation

SCHD doesn’t just pay dividends, it grows them year after year, and that’s where the real compounding power lies.

Over the past decade, SCHD has delivered 13 consecutive years of dividend growth, earning it an A+ grade on Seeking Alpha’s Dividend Scorecard. That kind of consistency is rare in the ETF world and speaks volumes about the quality of the underlying holdings and the discipline of its strategy.

Even more impressive is the pace of that growth. The 10-year compound annual dividend growth rate (CAGR) sits at 11.30%, with the 5-year CAGR coming in at 11.44%. The 3-year average clocks in at 11.26%, and even in the most recent 12-month stretch, SCHD managed to grow its dividend at an eye-popping 16.69%.

This is not just keeping up with inflation, it’s pulling ahead. When your income grows faster than your expenses, wealth builds without needing constant contributions. For investors reinvesting dividends, this means your income snowball accelerates faster every year.

At a current yield of 3.91%, SCHD offers a solid base payout. But it’s the combination of that starting yield with consistent double-digit growth that makes it special. You’re not just buying income—you’re buying an increasing income stream.

In short, SCHD rewards patience. And that makes it a perfect fit for long-term dividend investors who want more than just static yield. They want reliable, rising income and SCHD delivers exactly that.

In order to demonstrate the growth that SCHD can provide, I ran a back test of a $25,000 investment. The graph below assumes that you consistently invested $200 a month over the course of ten years. Your dividend growth continuously increases.

2016 Dividend Income: $933 annually

2024 Dividend Income: $6,042 annually

3. Low Fees Mean More Money in Your Pocket

The expense ratio on SCHD is just 0.06%. That’s six cents for every $100 you invest.

Compare that to actively managed dividend funds or other high-fee income ETFs, and the difference over time becomes staggering. Low costs mean more of the dividend income and capital appreciation goes to you, not the fund manager.

And because SCHD tracks a passive index, you avoid the hidden risks that come with emotional, discretionary management.

4. It’s Built to Be Held Forever

SCHD’s construction rewards patience. It’s not meant to be traded. It’s meant to be owned.

You won’t find speculative growth names or trendy tech bets here. Instead, you’ll see names like Texas Instruments, PepsiCo, Amgen, and Lockheed Martin. These are companies with real earnings, shareholder alignment, and long histories of rewarding investors.

This is the type of ETF you can buy, reinvest the dividends, and watch your income climb year after year. It’s a rare blend of income, growth, and peace of mind.

5. SCHD Works With Almost Any Strategy

Whether you’re in the accumulation phase or living off your portfolio, SCHD fits.

For younger investors, the dividend growth and reinvestment potential is powerful. For retirees, SCHD delivers reliable, quarterly income from top-tier companies. And for anyone in between, it serves as a rock-solid core holding that balances risk and reward.

You can pair SCHD with higher-yield monthly ETFs for added cash flow, or let it stand alone as your primary dividend growth engine. SCHD is actually my largest personal holding within my dividend portfolio and it accompanies my more frequent paying dividend stocks.

10 Monthly Dividend Stocks That Pay Me $1,688💸

Most investors wait every quarter to collect their dividends.

Final Thought: SCHD Is Boring—and That’s Why It Wins

SCHD doesn’t chase headlines. It doesn’t hype returns. It just quietly compounds.

And over time, that’s what builds wealth. Predictable payouts. Steady growth. Low fees. Strong companies. That’s what SCHD delivers—and it’s why so many dividend investors consider it the crown jewel of their portfolios.

If you believe in letting time and consistency do the heavy lifting, SCHD might be the best investing partner you’ll ever find.