How The Stock Market Reacts To War

Markets, Missiles, and Momentum: What History Says About War and Stocks

With the U.S. reportedly striking Iran’s nuclear facilities, geopolitical risk is back in focus. Wars have always had a complicated relationship with markets: they spike uncertainty and fear, yet surprisingly, markets often bounce back quickly.

Let’s unpack how the stock market typically reacts during times of war, what history tells us, and what it might mean for investors today.

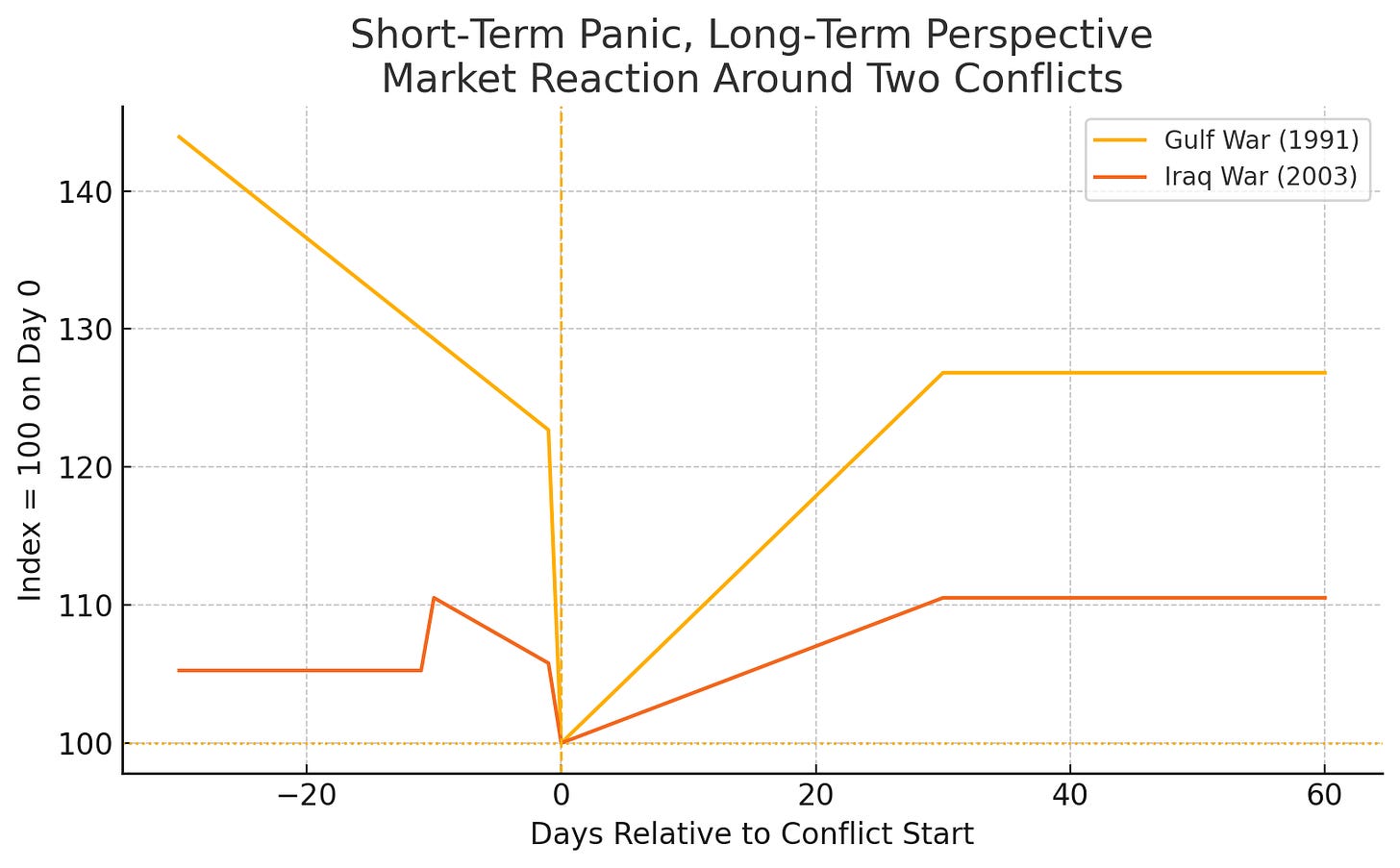

Short-Term Panic, Long-Term Perspective

When war breaks out or seems likely, markets often sell off. Investors rush into safe havens like gold, bonds, and the U.S. dollar. That happened before the 2003 Iraq War and again in early 2022 when Russia invaded Ukraine.

But here’s the twist: once the fighting starts and the situation becomes clearer, markets often stabilize or even rally. There's an old saying: “Buy on the sound of cannons.” That proved true during the Gulf War and Iraq War. In both cases, stocks rebounded fast once it became clear the U.S. had the upper hand.

Why? Because markets hate uncertainty more than bad news. Once the worst-case scenarios are off the table, investors often return to focusing on fundamentals.

Gulf War (1990–1991): Fast Drop, Faster Recovery

When Iraq invaded Kuwait, the S&P 500 fell nearly 18%. Oil spiked above $40 a barrel. But as soon as the U.S. launched Operation Desert Storm in January 1991 and markets saw it would be a quick win so stocks soared. The S&P gained 17% in just four weeks and ended the year up 30%.

Iraq War (2003): Same Script, New War

In the lead-up to the Iraq invasion, stocks drifted lower. But once the war started and Baghdad fell quickly, the market rallied. Oil, which had been rising on fear, dropped almost 30% within weeks. The S&P finished 2003 up 26%. The lesson? Fear often peaks before the first missile is fired.

The Big Picture: Wars Usually Don’t Derail Markets

Over time, markets tend to look past war, unless it disrupts the economy in a massive way. World War II, Vietnam, and even the post-9/11 conflicts didn’t stop long-term market growth. Most U.S.-involved wars since WWII have been regional and had minimal direct impact on corporate earnings or economic growth.

There are exceptions. If a war disrupts global trade routes (think: Strait of Hormuz) or drags on with no end in sight, markets can stay choppy. But history suggests most conflicts become background noise fairly quickly, especially for long-term investors.

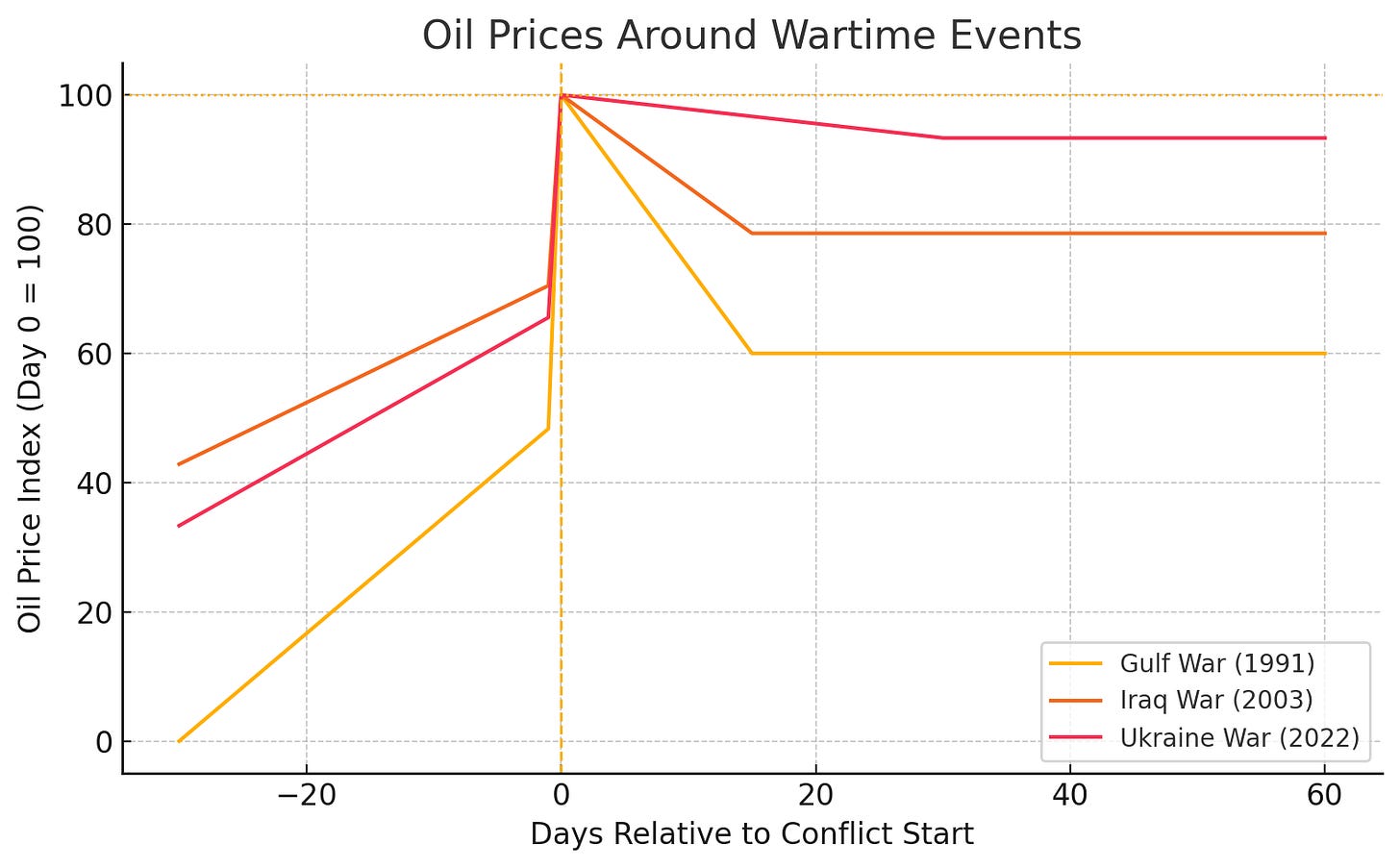

What Happens to Oil and Energy Stocks?

Wars involving oil-producing regions usually send crude prices higher. That’s good for energy stocks. During the 2022 Ukraine war, the S&P Energy sector soared over 65% while most other sectors fell. But beware: war-related oil spikes often fade just as quickly as they came. If the war wraps up or supply disruptions are avoided, oil prices can crash just like they did in 1991 and 2003.

Here’s a chart showing how oil prices typically behave around major wars:

Oil spikes hard before conflicts, especially when supply risk is high.

Once the conflict starts — and if supply isn’t actually disrupted — prices often fall back quickly (as in 1991 and 2003).

But in some cases, like the 2022 Ukraine invasion, oil stayed elevated longer due to sanctions and broader instability.

Bottom line: energy stocks often lead early in wartime, but gains can evaporate if the geopolitical risk premium vanishes.

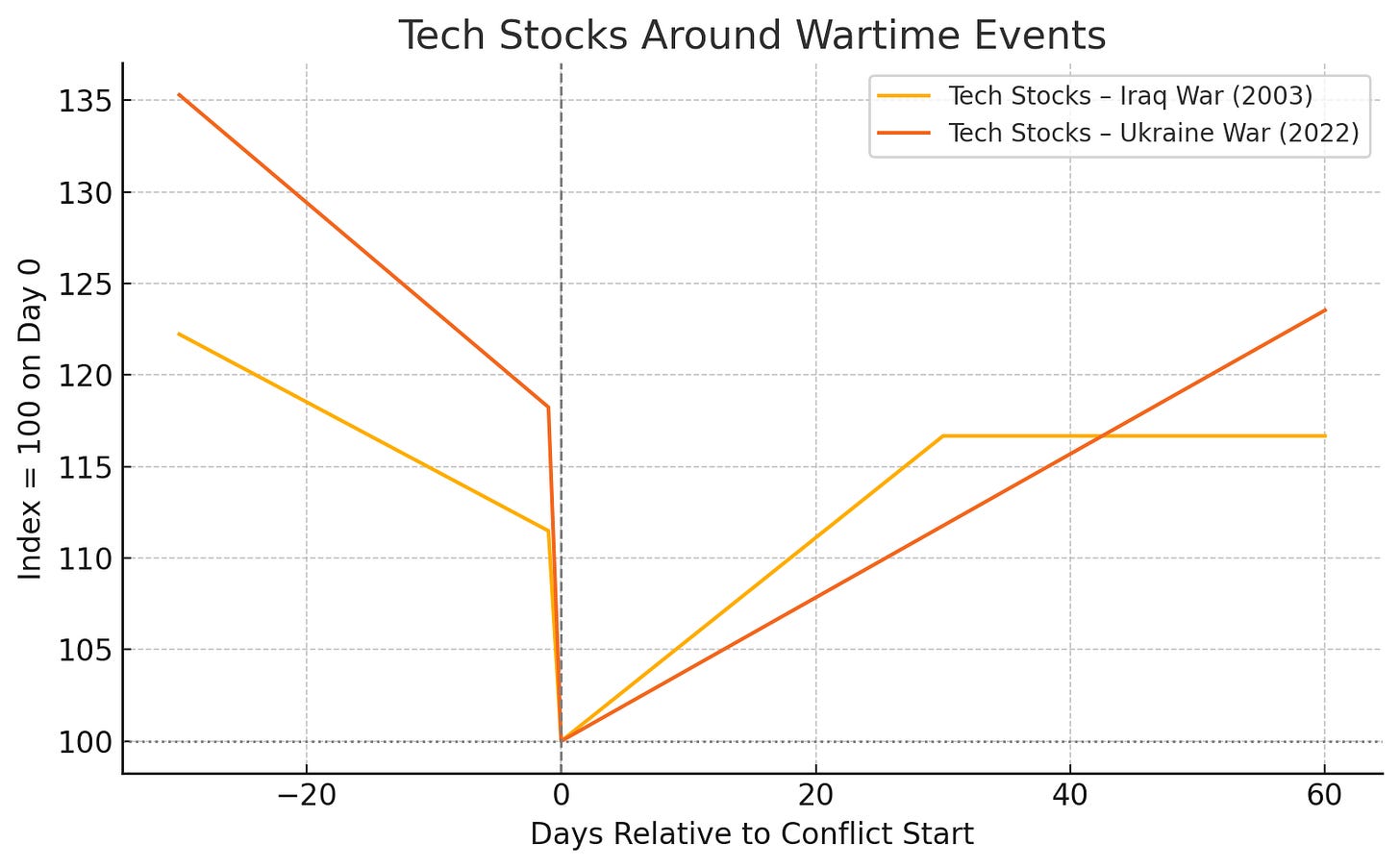

What About Tech?

Tech tends to underperform during the panic phase especially when war stokes inflation and interest rates rise. That’s what happened in early 2022. But tech also tends to rebound hard once stability returns. After the 2003 Iraq invasion, beaten-down tech stocks staged a major comeback. And by late 2023, despite the ongoing Ukraine war, mega-cap tech was hitting new highs again.

Some parts of tech like defense contractors and cybersecurity firms, actually benefit from conflict. Governments increase military budgets, and companies spend more to protect against cyber threats.

Here’s the chart now displaying properly. It shows how tech stocks typically respond around wartime events:

Tech underperforms leading into conflict (due to fear, inflation, and rate concerns)

Then rebounds as uncertainty fades and fundamentals come back into focus

What It Means for Today

If tensions with Iran escalate, expect more volatility. Oil could spike. Energy stocks may rally. Safe havens like gold and the dollar could catch a bid.

But if the conflict is limited and resolves quickly as has often happened in past Middle East flare-ups, markets may bounce right back. And sectors like tech could resume their leadership.

The biggest takeaway? Stay calm. History shows that selling in fear rarely pays. Wars make headlines, but over time, markets move to the beat of earnings, interest rates, and economic growth.

Stocks That Could Benefit in Wartime Scenarios

When tensions rise, not all stocks suffer. In fact, certain companies and sectors can gain meaningful tailwinds, especially those tied to energy, defense, cybersecurity, and critical infrastructure.

Here are some noteworthy tickers to keep an eye on if conflict escalates:

🛢️ Energy & Oil Producers

Geopolitical conflict often lifts oil prices, which can directly boost the revenues of energy giants:

XOM – ExxonMobil: One of the largest integrated oil companies. High exposure to global crude prices.

CVX – Chevron: Another oil major with diversified upstream/downstream operations.

VLO – Valero Energy: A top U.S. refiner that can benefit from widening refining margins during oil price shocks.

OXY – Occidental Petroleum: More volatile, but strong exposure to crude oil price swings.

🔒 Defense Contractors

Wars and rising military budgets tend to flow straight into defense and aerospace companies:

LMT – Lockheed Martin: Maker of fighter jets, missile systems, and other high-ticket military hardware.

RTX – RTX Corp (formerly Raytheon): Focused on missile systems, radar, and aerospace tech.

NOC – Northrop Grumman: Key player in space, drone, and defense technologies.

GD – General Dynamics: Ground systems, ships, and military services.

🖥️ Cybersecurity & Intelligence

Modern warfare isn’t just physical — cyberattacks often ramp up, boosting demand for digital defense:

PANW – Palo Alto Networks: Offers enterprise-grade network security and threat detection.

FTNT – Fortinet: Known for firewalls and security appliances; growing government customer base.

CRWD – CrowdStrike: A leader in endpoint security and threat intelligence.

PLTR – Palantir Technologies: Works with government agencies on big-data analytics and defense intelligence.

🏗️ Critical Infrastructure & Commodities

Supply chain concerns and infrastructure upgrades tied to wartime readiness can boost demand here:

NUE – Nucor: Steelmaker that could benefit from increased infrastructure and defense material demand.

CCJ – Cameco: A uranium producer. Nuclear energy plays often catch a bid when oil is volatile or unstable.

ET – Energy Transfer LP: Midstream energy player with pipeline infrastructure — can benefit from regional rerouting needs.

How $250 A Month Can Turn Into a Reliable Passive Income Stream

Most people overestimate what they can do in a year, and underestimate what they can build in a decade. When it comes to long term investing, consistency beats intensity. And SCHD is one of the best ETFs for consistent dividend investors who want to build real, usable income over time.

Final Thoughts

Not all of these stocks will perform the same. Some are more speculative, others more stable but these are names historically tied to conflict-related catalysts. As always, do your own due diligence, and think in terms of portfolio balance. A defensive posture doesn’t mean abandoning growth. It means understanding the macro chessboard.

Great analysis on the nuanced ways markets price geopolitical conflict. It’s clear that war impacts are rarely binary—initial volatility often gives way to differentiated sector rotations, with defense, energy, and commodities typically benefiting, while others face pressure. I appreciate the emphasis on understanding both immediate shocks and longer-term structural shifts in risk appetite and capital flows. A timely reminder that context and adaptability remain paramount for investors navigating uncertainty.