Is DGRO Still One of the Best Dividend Growth ETFs in 2025?

*Includes Downloadable Analysis - How DGRO Quietly Builds Long-Term Wealth Through Dividend Growth

Not all dividend ETFs are built for income. Some are built for growth and DGRO is one of the cleanest examples of that strategy.

I’ve owned SCHD and other high-yield dividend funds for a while, but DGRO plays a different role. It’s designed to grow dividends over time, not just pay them today. In this article, I’ll break down what makes DGRO unique, how it compares to its closest rivals, and where it fits in a modern income portfolio.

As a thank you to readers, I am attaching a more in-depth analysis of this fund to download for free.

What Is DGRO? DGRO 0.00%↑

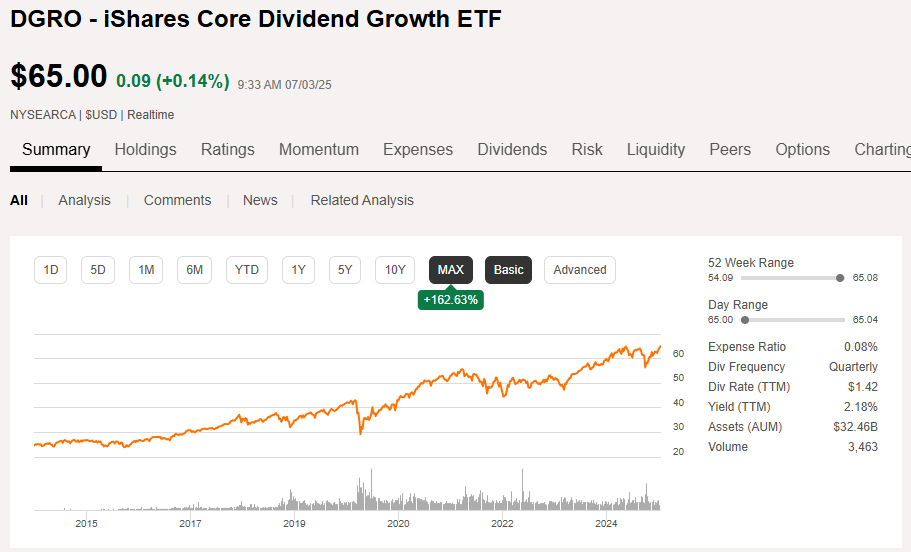

DGRO is the iShares Core Dividend Growth ETF, designed to track U.S. companies with a history of sustained dividend growth. It uses a rules-based strategy that filters out companies with declining or unsustainable payouts and focuses only on those increasing their dividends annually.

Yield: ~2.2%

Expense Ratio: 0.08%

Number of Holdings: ~400

Top Sectors: Healthcare, Tech, Financials

Strengths

✅ Dividend Growth Focus

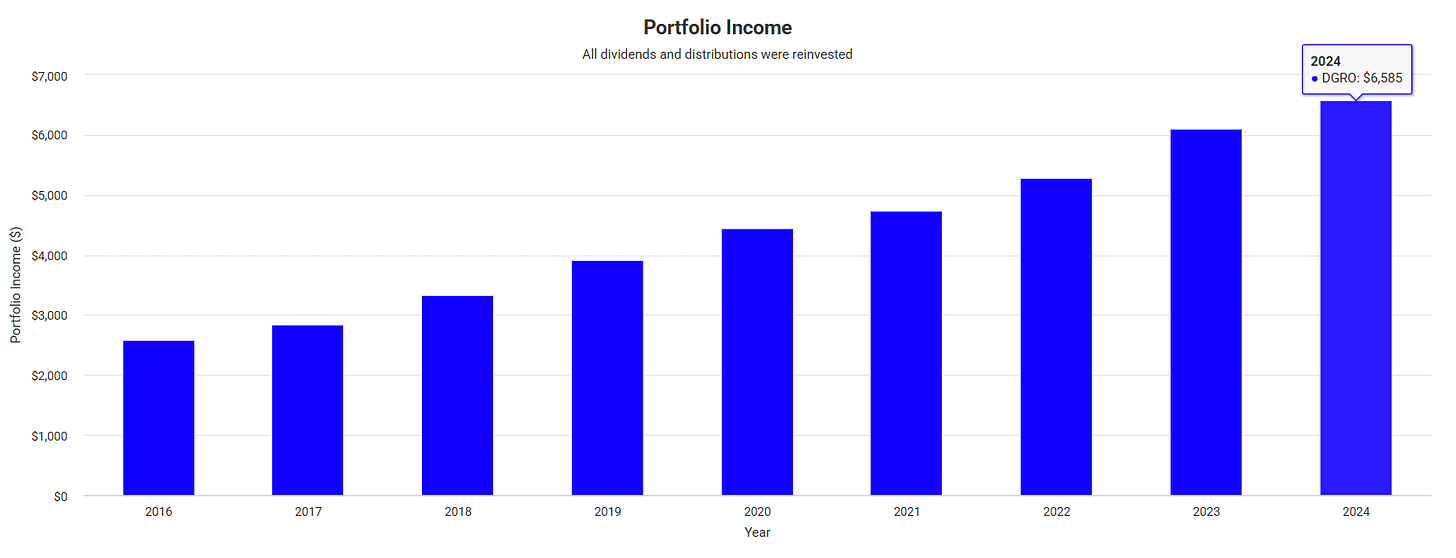

DGRO only includes companies that have increased their dividends for at least five consecutive years. This helps ensure you own businesses that are financially stable and shareholder-friendly. The dividend has increased at an average annual growth rate of 9% over the last ten years. Imagine getting a 9% raise every single year from your job? Think about how quickly that income would grow.

This dividend growth has proven that is can substantially increase your annual dividend income. If you were to invest $25,000 at the start of 2016, and NEVER added any more capital, your dividend income would have increased from ~$2,500 up to ~$6,500 without any effort on your part. This growth would have been completely passive. Now obviously $6,500 a year isn’t anything life changing but these sort of ETFs are more efficient when you consistent add capital every month.

✅ Low Turnover, Low Fees

At just 0.08%, DGRO is incredibly cheap to hold. Combine that with a relatively low turnover strategy and you get tax efficiency and consistent exposure.

✅ Diversified and Quality Tilted

Top holdings like Apple, Microsoft, UnitedHealth, and JPMorgan offer a balanced blend of quality, growth, and dividend dependability.

✅ Reinvestment Friendly

Because of the lower yield and steady growth focus, DGRO is a great core position for long-term reinvestment and compounding.

Potential Weaknesses

⚠️ Lower Yield Than SCHD or VYM

If you’re building your portfolio for immediate income, DGRO’s ~2.3% yield may feel underwhelming. It’s more of a growth-first, income-later play.

Why This Might Be the Greatest Dividend Growth ETF Ever Created

We are living in an era where inflation is no longer a background risk. It is front and center. While it has cooled from its 2022 peak, core inflation in the United States still hovers above the Federal Reserve’s two percent target, and many essential goods and services continue to rise in price year over year.

⚠️ No Yield Chasing

DGRO avoids high yielders entirely. That’s great for safety — but not for those seeking current cash flow.

⚠️ Overlap With Growth ETFs

Its heavy tech and financials exposure gives it overlap with total market or growth ETFs like VTI or QQQM. DGRO is also likely to underperform because it excludes a lot of growth holdings, such as Amazon AMZN 0.00%↑ or Tesla TSLA 0.00%↑ .

Top 10 Holdings (As of 2025)

Here’s a snapshot of its largest positions:

XOM 0.00%↑, JPM 0.00%↑, AAPL 0.00%↑, MSFT 0.00%↑, JNJ 0.00%↑, ABBV 0.00%↑, PG 0.00%↑, AVGO 0.00%↑, HD 0.00%↑, CME 0.00%↑

Where DGRO Fits in My Strategy

DGRO doesn’t replace SCHD SCHD 0.00%↑ or my higher-yield ETFs — it complements them.

I use DGRO as a dividend growth anchor within a retirement portfolio. It grows slower but steadier. While other funds like GPIX 0.00%↑, YMAX 0.00%↑ , or even GOF 0.00%↑ crank out income now, DGRO builds long-term compounding that will pay off bigger later.

If I want to fund my 30s and 40s, I hold high-yield funds. If I want to build a cushion for my 50s and beyond, I hold DGRO.

Looking back on the performance over the last DECADE, we can see that DGRO outperforms SCHD when including all dividends.

Final Thoughts

DGRO is not for thrill-seekers or income chasers. But if you want a rock-solid, tax-efficient dividend growth engine with quality names and low fees, this ETF deserves a serious look.

I won’t expect DGRO to make me rich overnight but I do expect it to keep raising the bar on dividend growth, year after year.

If you’re building for the future and want steady compounding baked into your portfolio, DGRO might be your quiet MVP.

Seeking Alpha Downloadable Analysis