The Real Reason Most People Will Never Get Rich

Why mindset matters more than money and how simple shifts can unlock the path to real wealth.

Getting rich is more possible now than ever before. The internet has made information free. Brokerage apps have made investing frictionless. Side hustles and business models are more accessible than any other time in history.

So why are most people still stuck?

It is not a lack of intelligence. It is not a lack of opportunity. And it is not just about how much you earn. The real reason most people never build lasting wealth comes down to mindset.

They spend before they invest.

They wait until it is too late.

They fear risk more than they fear being broke.

They keep making the same decisions while expecting different results. And over time, they fall into a cycle of surviving instead of building. Are there a bunch of external factors that can make it challenging to grow wealth? Of course. But how long are you going to let that stop you? Getting rich is not a secret. It is not reserved for the lucky few. It is a series of choices repeated with discipline. The people who break free are the ones who think longer, act faster, and prioritize assets over lifestyle.

1. People’s Inability to Delay Gratification

At the core of wealth-building is one uncomfortable truth. You have to wait.

You have to wait while your investments grow.

You have to wait while your income compounds.

You have to wait while everyone else looks like they are ahead of you.

Most people cannot do it.

Delayed gratification is not natural. We are wired for now. We want comfort now. We want results now. We want to feel successful now. And that constant need for immediacy kills long-term progress.

This is why so many people spend their money as soon as they earn it. It feels better in the moment. A new phone. A better apartment. A quick trip. These things provide instant satisfaction but take away from the capital needed to build real wealth.

Sure, in the moment it might feel harmless. You’re young and should enjoy life right? How many times have you been told this statement from people that are still punching the clock? Now is there some validity in these sort of statements? Of course. But ask yourself what you value more and align yourself with that.

Wealth does not reward speed. It rewards patience. The people who win are the ones who can sit with discomfort. They can look broke while getting rich. They can put off buying things they want today because they are focused on what those dollars can become tomorrow. You will never build anything meaningful if you constantly interrupt your compounding with consumption. You have to choose growth over gratification. You have to get used to the feeling of restraint. And you have to realize that the rewards come all at once, not in the beginning.

If you cannot delay, you cannot build. It really is that simple.

How $250 A Month Can Turn Into a Reliable Passive Income Stream

Most people overestimate what they can do in a year, and underestimate what they can build in a decade. When it comes to long term investing, consistency beats intensity. And SCHD is one of the best ETFs for consistent dividend investors who want to build real, usable income over time.

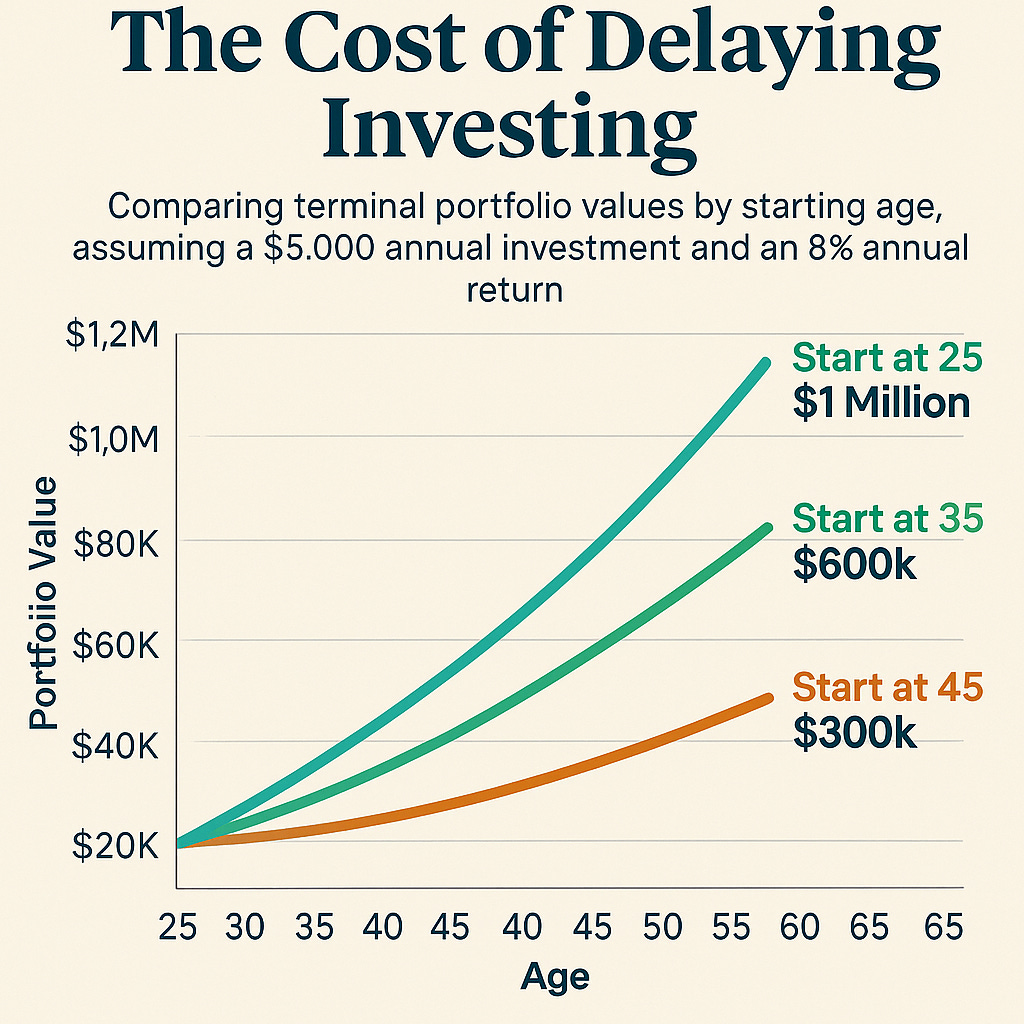

2. There Is No Urgency Until It Is Too Late

Most people wait too long to get serious about money.

They assume they have time. They assume things will eventually work out. They assume they can figure it out later. But wealth does not reward waiting. It rewards urgency.

The earlier you start, the more powerful your results become. A dollar invested in your twenties can become ten or twenty dollars by retirement. A side hustle started early can grow into a full-time business. A skill learned now can compound in value for decades.

But people do not move with urgency. They wait for the perfect time. They tell themselves they will start when things calm down. When they make more. When the market looks better. When they feel ready. After they finish Love Island on Netflix.

The moment never comes.

Life gets more expensive. Time slips away. Responsibilities pile up. What was once a small step becomes a mountain. And suddenly, it is no longer about building wealth and it’s instead about catching up. The wealthy treat time like a limited asset because it is. They understand that every day without action is a day compounding is not working for them. They move fast even when it is uncomfortable. They start before they feel fully prepared and they create momentum while others are still waiting for permission.

If you do not act with urgency now, you will act with regret later. Time does not wait. And neither does opportunity.

3. Fear of Risk Keeps Them Stuck

Most people say they want to be rich. But what they really want is to be rich without ever taking a risk. They want safety. They want guarantees. They want growth without uncertainty. But that version of wealth does not exist.

Every path to financial freedom requires risk. Starting a business is risky. Investing is risky. Using leverage is risky. Even learning a new skill can feel like a risk when there is no guaranteed outcome. The difference is that wealthy people learn to take smart, calculated risks. They understand that risk is not something to avoid. It is something to manage.

The average person sees any type of volatility and immediately retreats. They see a market drop and pull out. They see a job opportunity that pays commission and turn it down. They see an investment that requires patience and label it dangerous.

This mindset keeps them stuck in a loop. Safe job. Safe savings account. Safe choices. But with no upside. No real growth. No wealth.

Meanwhile, people who understand risk treat it like a tool. They know there are risks in every direction, including doing nothing. They know sitting in cash is risky. They know staying in the wrong job is risky. They know relying on one source of income forever is risky. So they move. They act. They build.

The goal is not to be reckless. The goal is to be strategic. Take small risks early. Learn from them. Expand your comfort zone. Over time, those risks become your advantage.

If you let fear make your decisions, you will live a life designed by hesitation. But if you learn to understand and manage risk, you open the door to opportunity.

It's Easy To Outperform The S&P 500 - Here's How

Over the past year, my portfolio is up 33.68%, more than doubling the return of the S&P 500 and trouncing the average diversified “blended” portfolio by nearly 20 percentage points. While most investors are taught to diversify and play defense, I’ve taken a more aggressive, intentional approach and the results speak for themselves.

4. Poor Decision Making With the Money They Have

You do not need to be rich to build wealth. You just need to make better decisions with the money you already have.

Most people do not.

They spend without intention. They buy things they cannot afford to impress people who do not care. They lease liabilities instead of owning assets. They invest in hype but ignore fundamentals. They treat money like something to spend as fast as possible instead of something to grow.

The truth is you can build a meaningful portfolio on an average income if your decisions are smart and consistent. But instead of stacking assets, many people stack payments. Car payments. Phone payments. Subscription payments. All of it adds up and drains the ability to invest in anything real.

Poor decision-making is not just about spending. It is about what people ignore. They ignore compound interest. They ignore their credit score. They ignore tax advantages. They ignore the value of ownership. Over time, that ignorance becomes expensive.

Wealthy people treat every dollar like an employee. That money gets a job. It gets sent to work in investments, in businesses, in tools that multiply it. Every decision is filtered through a long-term lens. Does this help me grow or does this slow me down?

You do not need perfection. You just need direction. Make more good decisions than bad ones. Avoid the obvious traps. Spend with intention. Save with purpose. Invest with clarity.

Every dollar you earn is a chance to either build something or burn it.

Conclusion

Most people never get rich not because they lack opportunity, but because they fall into mental and behavioral traps that quietly kill their chances. They chase lifestyle before assets. They delay important decisions until the cost of waiting becomes permanent. They fear risk so deeply that they stay stuck. And when they finally have the resources to grow, they waste them on short-term pleasures and poor choices.

Wealth is not magic. It is not reserved for the ultra-privileged. It is built by people who think differently, act sooner, and stay consistent when others quit. If you can delay gratification, move with urgency, embrace calculated risks, and treat your money like a tool instead of a toy, your path to wealth becomes inevitable.

Most people never get rich because they never change. But you can. Start now. Start small. And do not stop.

Thank you for the well written and true article.

“They fear risk more than they fear being broke.” yesss! Great stuff here