The Weekly Dividend Hack: How I Get Paid Every Week From The S&P 500 & Nasdaq

A smarter way to turn index volatility into real, weekly dividend income.

For most people, money shows up on a schedule. It might be every two weeks if you’re lucky, or maybe once a month. That rhythm controls everything. Your rent is timed to it. Your bills are aligned with it. Your stress rises and falls with it.

The problem is, you don’t control that timeline. Your employer does.

If you’ve ever sat waiting for a paycheck to hit your account so you can cover the basics, you already know the feeling. It’s not just stressful. It’s limiting. You delay decisions. You hold off on opportunities. You think smaller because your money is drip-fed.

That’s how most investors treat dividends, too.

They wait every quarter for a small payout from an index fund or blue-chip stock, then reinvest it and forget about it. And sure, that strategy works over the long term. But it’s not designed for cash flow and it doesn’t help much if you’re trying to build income you can actually use.

I got tired of waiting.

That’s when I found a different approach. Weekly income from the indexes. It allowed me to collect dividends like this.

Using synthetic income ETFs, I’ve been able to turn exposure to names like SPY, QQQ, and the Russell 2000 into weekly paydays that drop into my account like clockwork. Not every quarter. Not every month. Every single week.

And it changed everything. The way I allocate, the way I budget, the way I plan.

In this post, I’ll break down how I built my weekly dividend strategy using synthetic ETFs that monetize volatility from the major indexes. I’ll show you the funds I use, how they work, what they pay, and where they fit into a larger income-focused portfolio.

If you’ve been building a portfolio that looks good on paper but doesn’t pay you consistently, this is for you.

Most investors buy index funds like SPY or QQQ and wait three months for a dividend that barely dents inflation. I wanted more.

So I built a portfolio that pays me every single week - and it’s all built on exposure to the same indexes you already know.

This article breaks down how I collect consistent, high-yield income from SPY, QQQ, and the Russell 2000, using synthetic income funds that transform market volatility into weekly paydays.

If you’re focused on cash flow over long-term growth, these tools belong in your income stack.

🔍 What’s the “Weekly Index Dividend” Strategy?

Let’s be clear: SPY, QQQ, and IWM do not pay weekly. They’re great trackers for capital appreciation and long-term growth. These are the funds that you buy and hold for decades. They weren’t built for consistent income.

That’s where synthetic income ETFs come in.

These funds use derivatives and option overlays to replicate index exposure while harvesting premium from daily or weekly volatility. Instead of waiting 90 days for a payout, I get a cash deposit every week — sometimes multiple times a week, depending on which funds are in rotation.

10 Monthly Dividend Stocks That Pay Me $1,688💸

Most investors wait every quarter to collect their dividends.

A Quick Note on Return of Capital and Taxes

Many of the synthetic income ETFs I hold — including the YieldMax and 0DTE funds — classify a portion of their distributions as return of capital (ROC). While that might sound like a red flag, it’s actually a tax-efficient feature when used correctly.

Return of capital means the fund is returning part of your original investment as a distribution, instead of paying out earnings or short-term capital gains. Here’s why that matters:

You don’t pay taxes on return of capital in the year it’s received

Instead, your cost basis is reduced, and you pay taxes only when you eventually sell

This defers taxes and can lower your overall tax burden if managed properly

In other words, these funds can generate high-frequency cash flow with limited immediate tax consequences. That makes them especially useful in taxable accounts, though you’ll still want to track basis changes for reporting purposes.

Of course, if you're holding them inside an IRA or Roth, this becomes even simpler — but for cash-flow investors in non-retirement accounts, return of capital adds a hidden bonus layer of flexibility.

💵 The Funds That Pay Me Weekly

Here are the core positions I’m using to generate weekly income from index exposure:

XDTE – Roundhill S&P 500 0DTE Covered Call ETF

Tracks: S&P 500 (SPY) exposure

Payouts: Weekly

Yield: Varies, often 32% annualized

Role in my portfolio: High-frequency income from large-cap market volatility

If I could sum up XDTE in one sentence, it would be this: a way to get paid every week off the volatility of the entire market.

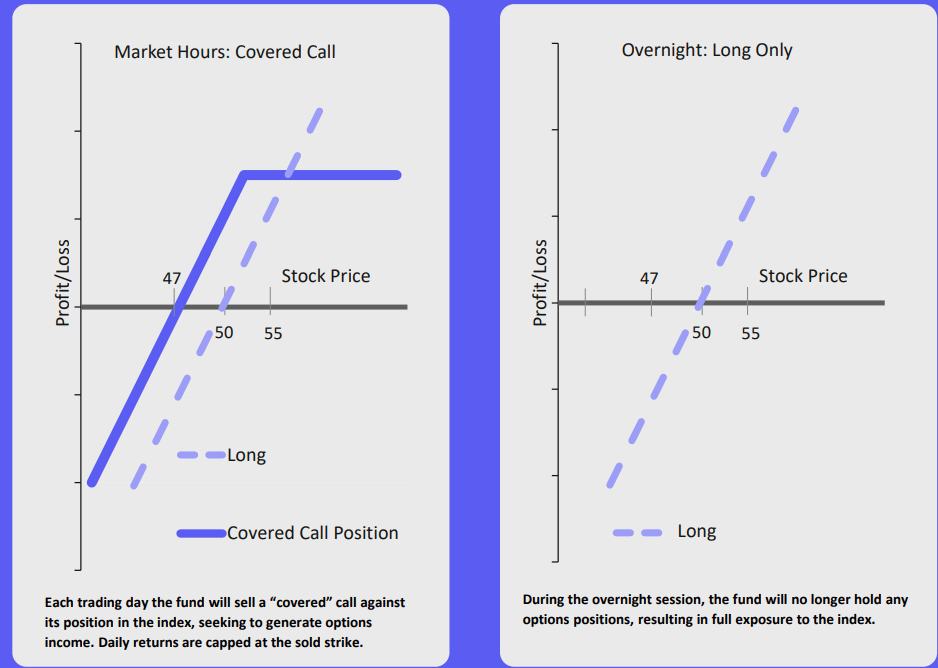

This ETF doesn’t hold individual S&P 500 companies. Instead, it uses daily options contracts — specifically zero-day-to-expiration (0DTE) covered calls — to generate consistent premium income from the price swings of the index.

Every trading day, XDTE sells call options on S&P 500 futures that expire that same day. Because there’s no time value beyond a few hours, these contracts carry high implied volatility and deliver rich premium, even when markets are flat. That premium is then pooled and paid out to shareholders once per week.

It monetizes the market’s day-to-day movement without needing to own 500 individual stocks

I receive cash flow every Friday, which smooths my income and offsets less frequent payers

It’s highly liquid, passively managed, and does not require me to trade or time anything

It brings in consistent yield even when the market trades sideways or chops back and forth

Unlike traditional index funds that are built for long-term compounding, XDTE is built to generate income from near-term movement. That makes it perfect for a portfolio like mine, which prioritizes cash flow over capital gains.

QDTY – YieldMax Nasdaq 100 0DTE ETF

Tracks: QQQ / Nasdaq 100

Payouts: Weekly

Yield: 28 - 40%+ annualized (but fluctuates)

QDTY is my go-to for extracting income from tech sector volatility. It’s designed to generate yield from the price movements of the Nasdaq 100, which includes heavyweights like Apple, Microsoft, NVIDIA, Meta, and Amazon — but with none of the direct stock ownership.

Like XDTE, QDTY uses a zero-day-to-expiration (0DTE) covered call strategy, which means it sells call options that expire at the end of the same trading day. But instead of using S&P 500 exposure like XDTE, QDTY focuses exclusively on the Nasdaq 100, which tends to be more volatile — and that means more income potential.

Because tech stocks move faster and more aggressively than the broader market, QDTY is often able to harvest larger premiums than XDTE on a percentage basis. That makes it a strong candidate for weekly income with slightly higher risk and slightly higher yield.

It allows me to tap into Nasdaq 100 momentum without buying tech stocks directly

The options strategy turns volatility into weekly cash flow

It fits well alongside XDTE to diversify index exposure while keeping income frequency high

I treat it like a tech-focused income engine — not a growth fund, but a cash machine

In practice, QDTY delivers weekly payouts based on how much premium was collected during the prior week. Just like XDTE, the distributions are deposited regularly, which helps smooth out my income stack and keeps money flowing into my account all month long.

RDTY – YieldMax Russell 2000 0DTE ETF

Tracks: IWM / Small Caps

Payouts: Weekly

Yield: 28% - 35%

RDTY is the most aggressive of the weekly-paying synthetic index funds I own. It targets the Russell 2000, which is made up of small-cap U.S. companies, a sector known for its higher volatility, lower liquidity, and sharper price swings compared to large-cap indexes like the S&P 500 or Nasdaq 100.

That volatility is exactly what makes RDTY useful. Like its sister funds XDTE and QDTY, RDTY sells zero-day-to-expiration (0DTE) call options against index exposure. Because the Russell 2000 is more erratic, the options written by RDTY often come with juicier premiums, which means larger weekly payouts for income-focused holders like me.

Of course, higher premiums come with more risk. Small-cap stocks tend to be more sensitive to economic downturns, interest rate hikes, and risk-off sentiment. That makes RDTY more volatile than XDTE or QDTY, but it also means it can deliver serious yield when markets are active.

It gives me weekly cash flow from a part of the market I wouldn’t normally target for income

It balances out my large-cap index funds with unconventional exposure

RDTY often delivers larger weekly payouts than XDTE or QDTY because small caps move more

It’s a tactical yield booster, not a core holding, I size it accordingly

This fund is perfect for income-focused investors who can handle some chop. When volatility spikes, RDTY can outperform other index-based income funds on yield alone. But I treat it as supplemental income, not foundational cash flow.

SDTY – YieldMax S&P 500 0DTE Strategy

Tracks: S&P 500

Payouts: Weekly

Yield: 28% - 35%

SDTY is another fund designed to generate weekly income from the S&P 500, but it comes from YieldMax, not Roundhill, and that distinction matters.

Like XDTE, SDTY uses zero-day-to-expiration options on the S&P 500 to harvest premium through daily covered calls. These contracts expire the same day they are opened, which means all of the time value is extracted quickly. The more the market moves intraday, the more SDTY can collect.

Where SDTY differs is in the implementation. While the mechanics of the strategy are similar to XDTE, YieldMax may take a slightly different approach to strike selection, contract frequency, or cash management, which can lead to slightly different results in terms of yield or NAV stability.

For income-focused investors like me, SDTY serves as a way to diversify within the 0DTE income model. It adds another source of weekly cash flow tied to the S&P 500, but with a different tactical approach that can smooth out some of the performance variation from XDTE alone.

It provides a second stream of S&P 500-based income, separate from XDTE

It helps reduce reliance on one issuer or strategy

Distributions are weekly, consistent, and surprisingly competitive

SDTY helps me stack cash flow on top of my core monthly dividend names

It’s worth noting that YieldMax has built its reputation around single-stock synthetic income ETFs (like MSTY and AMZY), but SDTY is one of their first forays into index-driven 0DTE income — and so far, it’s proving to be a strong performer.

Similar to XDTE, the NAV will slowly erode over time due to the consistent call writing

It’s not a growth fund — this is a cash flow tool, not a buy-and-hold wealth builder

Because it’s newer and lower profile, volume and AUM may still be building compared to Roundhill’s XDTE

Distributions are taxable and fluctuate based on weekly volatility

In practice, SDTY is like layering a second weekly paycheck on top of XDTE — from the same underlying index, but with a different strategy. For anyone building a diversified weekly income portfolio, it’s a smart addition that adds depth without adding complexity.

If XDTE is my baseline S&P payer, SDTY is the next-level tactical complement that keeps the cash flowing and spreads the risk across issuers and methodologies.

🌐 YMAX / YMAG – Universe Funds

Tracks: Basket of single-stock YieldMax strategies

Payouts: Weekly

Yield: 40% - 70%

YMAX and YMAG are two of the most straightforward ways to bundle multiple synthetic income strategies into one fund. Instead of picking and managing a dozen separate single-stock option ETFs like MSTY, AMZY, or CONY, these funds give you a way to own them all in one shot — and still get paid weekly.

These are fund-of-funds ETFs that allocate across the YieldMax lineup. That includes big-name synthetic income ETFs tied to Microsoft, Apple, Amazon, Coinbase, Tesla, Nvidia, Meta, and more. The exact allocations vary slightly between YMAX and YMAG, but both serve the same core purpose: delivering high-frequency income through built-in diversification.

I don’t have to micromanage a dozen YieldMax tickers

I get exposure to multiple high-yield plays in one clean position

It still pays weekly, which stacks perfectly with my other income

It smooths out volatility across single-stock synthetics — when one underperforms, another may pick up the slack

If you like the idea of MSTY, AMZY, and FBY but don’t want to juggle all of them individually, YMAX and YMAG give you that access. And importantly, they still carry the same income-first DNA — with most of the funds inside built to generate monthly or weekly cash flow through aggressive options strategies.

For context, I currently receive $180/month from YMAX, and I treat it as a low-effort, high-output layer in my weekly income stack.

📦 YMAX vs YMAG — What’s the Difference?

While both funds are fund-of-funds built on top of YieldMax strategies, there are slight differences in their construction:

YMAX tends to include a broader mix, with a blend of mega-cap tech and high-volatility names

YMAG may lean more heavily into the “Magnificent 7” and other mega-caps with higher premium potential

Both rebalance regularly and adapt to market performance and volatility patterns

Either way, both accomplish the same goal — consistent weekly income without the complexity of managing 10+ tickers yourself.⚠️ What Are the Tradeoffs?

Let’s be clear: these are not growth funds. You are sacrificing upside for income — and in some cases, you’re doing it in a way that will erode NAV over time.

Key risks to know:

NAV decline: These funds are designed to pay, not preserve

Tax treatment: Distributions may be taxed as ordinary income

Yield fluctuation: Payouts can vary week to week based on volatility

Short-term instruments: These are active, options-driven ETFs — not passive buy-and-hold vehicles

That said, if your goal is to build a stream of weekly income to reinvest, cover bills, or stack into a cash buffer, they work.

🧠 Why I Use This Strategy

I used to wait 90 days to collect a $40 dividend from VOO or QQQ. Now I collect $40–$100 every week from funds that track the same indexes — and I don’t have to sell shares or chase gains.

It changed the way I think about financial freedom.

Weekly income is more than just a dopamine hit — it’s a system that removes guesswork. It’s how I build stability inside a volatile market. And if you’re focused on replacing part of your income with your portfolio, this is one of the smartest shortcuts I’ve found.

✅ Final Thoughts

You don’t have to abandon index investing to build income.

You just need to flip the strategy.

These synthetic income ETFs allow you to monetize the same indexes you already follow but get paid every week instead of every quarter.

It’s not for everyone. But if you’re building a dividend machine, this is a powerful lever worth adding.