This Week in Dividenomics: 2 High-Yield Picks I’m Watching📰

One for income, one for rebound—two high-yield opportunities I’m watching closely!

As part of my ongoing mission to build sustainable, compounding income, I’m always on the lookout for stocks that offer a mix of attractive yield, strong fundamentals, and long-term staying power. This week, I’ve got my eye on two very different names: a business development company (BXSL) and a long-standing retail giant (TGT). One delivers monster yield from floating-rate debt. The other is a dividend aristocrat undergoing a quiet turnaround.

Let’s break them down.

📌 Pick #1: BXSL – Blackstone Secured Lending Fund

Dividend Yield: ~10.6%

Structure: Business Development Company (BDC)

Sector: Private Credit / Middle Market Lending

🧠 Why It’s on My Radar:

BXSL is backed by Blackstone, giving it a serious edge in sourcing and managing middle-market debt. In an era of elevated interest rates, this fund is thriving. Nearly 100% of its portfolio is floating-rate, which means it directly benefits from higher-for-longer Fed policy.

Despite paying a high yield, BXSL is covering its dividend comfortably through net investment income—not return of capital. It’s one of the few BDCs I view as a viable long-term compounder rather than just a yield trap.

🔎 Key Metrics:

Net Investment Income (NII) covers the dividend with a cushion.

NAV has remained stable despite volatility in credit markets.

Trading at just a slight premium to NAV, which is rare for a top-tier BDC.

In fact, BXSL trades at a lower premium to NAV than all of 2024.

What I’m Watching: If interest rates start dropping in the second half of 2025, BXSL’s income might compress. But given how the Fed is positioning, I think there’s still runway here—plus, Blackstone’s credit selection gives them a defensive edge. I actually believe that BXSL may be tariff-proof since the portfolio is most focused on Software investments, making up 20%. I' suggest you review their latest portfolio breakdown.

📌 Pick #2: TGT – Target Corporation

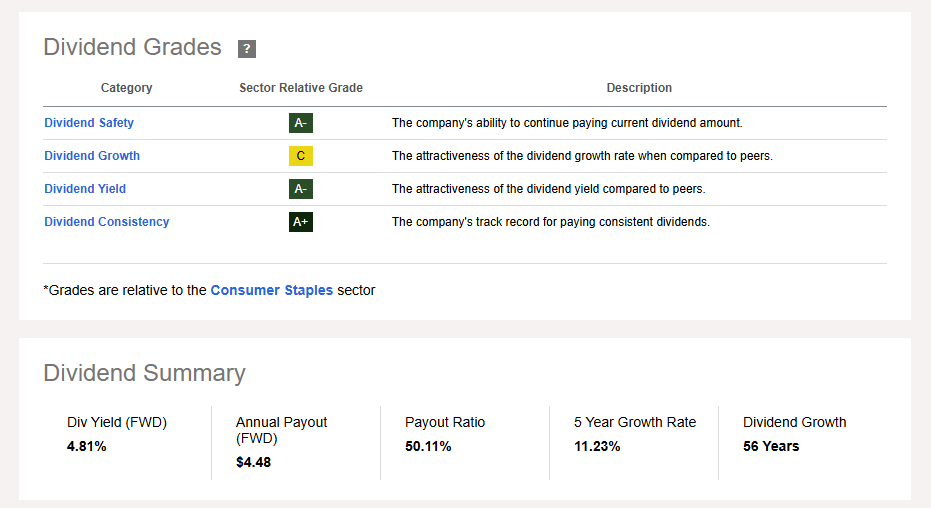

Dividend Yield: ~4.8%

Status: Dividend King (50+ years of increases)

Sector: Retail / Consumer Staples

🧠 Why It’s on My Radar:

TGT is quietly turning a corner. After getting crushed by margin compression and excess inventory in 2022–2023, they’ve taken steps to optimize their supply chain and reduce operational drag. The stock is still trading ~50% below its highs and offers a yield rarely seen from blue-chip retailers.

I see this as a yield + growth opportunity: the yield is solid, and there’s room for valuation expansion if margins recover. Meanwhile, you’re getting paid to wait. Target has a low payout ratio, strong dividend growth rate, and 56 years of consecutive increases.

🔎 Key Metrics:

Payout ratio ~50% (very sustainable).

Forward P/E under 11x—historically cheap for a retailer of this caliber.

Recent same-store sales showing signs of stabilization.

🧩 What I’m Watching: Walmart and Amazon are still eating away at the low-cost and delivery share, but Target has a strong niche in suburban convenience and loyalty programs. I’m watching for margin trends and any hints of a dividend hike this summer. I did previously release a more in-depth analysis on Target for free.

Target's Stock Trades At A Massive Discount

Market selloffs can be seen as a blessing. While other investors may panic, long term investors know that these conditions are when wealth is built. Target has fallen by more than 37% over the last twelve months. I think this presents an attractive buying opportunity and I plan to accumulate $10,000 worth of s…

🚀 Final Thoughts

BXSL offers pure income firepower backed by Blackstone’s credit team. TGT gives you blue-chip stability with rebound potential. Both serve different roles in an income-focused portfolio, and I’m actively evaluating entry points for each.

🔒 Want to see how these fit into my real-money dividend portfolio?

🔐 Paid subscribers get access to my portfolio breakdown, entry targets, and income strategy each month.