This Week in Dividenomics: 2 REITs I’m Watching Closely📰

Two high-yield REITs. Very different vibes. Both on my radar this month

📊 VICI Properties & Realty Income

As part of my strategy to build consistent, scalable income, I keep a close eye on assets that deliver monthly or quarterly cash flow, have inflation-resilient business models, and trade at undervalued multiples. This week, I’m digging into two names that check all three boxes: a newer REIT with a monster yield and a classic dividend machine trading near decade lows.

Let’s break them down.

📌 Pick #1: VICI Properties (VICI)

Dividend Yield: ~5.3%

Payout Frequency: Quarterly

Structure: REIT

Sector: Gaming / Experiential Real Estate

🧠 Why It’s On My Radar:

VICI flies under the radar for most retail investors because it’s not your typical real estate play. It’s the landlord for giants like Caesars, MGM, and The Venetian. I was never lucky enough to make money gambling, but I am smart enough to collect the profits from others. Translation: it owns the buildings that house some of the biggest cash-generating casinos in the country.

What makes VICI interesting isn’t just the exposure to gaming—it’s the predictability of the rent. Their leases are long-term (15–20 years), triple-net, and come with built-in CPI escalators. That means they pass property expenses to the tenant and get inflation-aligned rent increases. In today’s market? That’s gold.

Most of their revenue is tied to operators with deep pockets, and they’ve never had a missed rent payment. That’s a hell of a record for a REIT in a post-COVID world. Look at their metrics below - VICI warns an A+ for profitability and an A for growth.

🔎 Key Metrics:

AFFO payout ratio: ~64% ( extremely healthy)

5-year dividend CAGR: 7.7%

Portfolio cap rate: attractive for its sector

Tenant concentration risk is improving with new acquisitions

🧩 What I’m Watching:

VICI still relies heavily on a few key tenants. That introduces risk if Vegas slows down or consumer discretionary spending drops. But the diversification into golf resorts, experiential venues, and even sports arenas is a promising trend. If the Fed holds rates steady and REIT sentiment improves, VICI has room to re-rate while continuing to increase its dividend.

📌 Pick #2: Realty Income (O)

Dividend Yield: ~5.5%

Payout Frequency: Monthly

Structure: REIT

Sector: Retail / Triple-Net Commercial

🧠 Why It’s On My Radar:

This is the REIT everyone loves to hate lately. Realty Income is trading near multi-year lows, even though the business continues to deliver consistent FFO, steady acquisitions, and monthly dividends like clockwork.

Investors have been dumping O due to rate sensitivity—when yields rise, income-producing REITs get discounted. But that’s also the opportunity. This isn’t a flashy name. It’s not exciting. It’s reliable.

O owns over 13,000 properties across the U.S. and Europe. Think Walgreens, 7-Eleven, Dollar Tree—defensive tenants with long-term leases. Like VICI, O uses the triple-net lease model, which makes it more predictable and efficient from a margin standpoint. Look at Realty Income’s top tenants:

🔎 Key Metrics:

Dividend has been paid monthly since 1994

27 consecutive years of dividend increases

AFFO payout ratio: ~75–80%

Recent acquisitions improving geographic diversification

Stock trades at a ~15% discount to NAV

🧩 What I’m Watching:

If the Fed starts cutting rates in late 2025, Realty Income could rerate quickly. In the meantime, you’re being paid monthly to wait. The stock is currently yielding more than it did during the depths of the COVID crash—and it hasn’t missed a payment since. I’ve added to my position recently and may increase if it breaks under $50 again.

🚀 Final Thoughts:

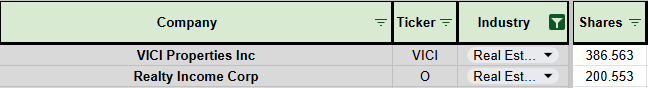

Both VICI and Realty Income offer high-yield income backed by real assets and long-term contracts. One gives you exposure to booming experiential venues. The other gives you rock-solid, boring-but-beautiful cash flow every month. I hold both—and I’m actively watching for entry points to add more. Just as some proof, here are my two positions in VICI and O -

🔒 Want access to my full REIT watchlist, real-money dividend portfolio, and monthly dividend breakdown?

📘 Paid subscribers get it all. Join Dividenomics Premium to see how I’m building $10,000/month in dividend income—one layer at a time.

If you missed last weeks newsletter, you can view that here.

This Week in Dividenomics: 2 High-Yield Picks I’m Watching📰

As part of my ongoing mission to build sustainable, compounding income, I’m always on the lookout for stocks that offer a mix of attractive yield, strong fundamentals, and long-term staying power. This week, I’ve got my eye on two very different names: a business development company (