How I’d Invest $10,000 To Eventually Earn $500/Month in Passive Income

A Simple, Safe Strategy to Turn Dividends Into Real Monthly Cash Flow

Let’s be honest. Most people don’t get excited about dividends because they think you need a million dollar portfolio just to see meaningful income. The dividend payments in the beginning are relatively small. It becomes harder to stick with it when you don’t feel like you’re seeing progress. However, this changes over time when you stay committed.

First it’s $10 a month.

Then $50 a month.

Then $100 month.

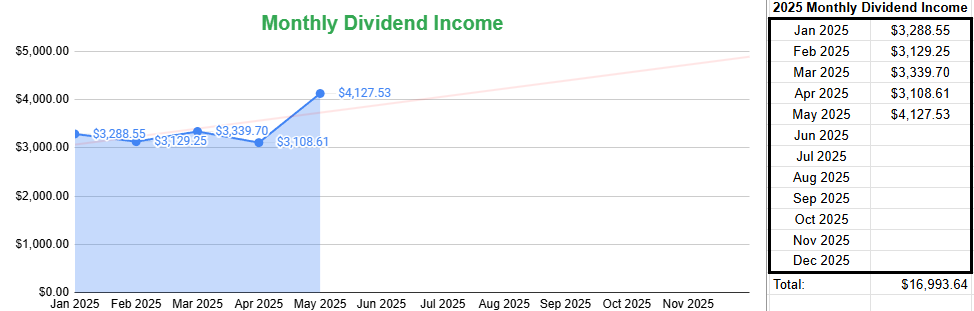

Then you finally cross $1,000 a month and it feels unreal to get paid for doing absolutely nothing. I was able to scale my income above $3,000 per month and that capital gets reinvested back into the growing snowball of dividends. I share dividend reports every month for readers that are interested. In May I was able to generate $4,127 in dividend income.

May 2025 Dividend Report

When I graduated college, my first job paid me about $3,000 a month. I worked full-time, sat in traffic, juggled deadlines, and waited two weeks for each paycheck to hit.

What if you could start with just $10,000 and build a growing stream of passive income. It will grow to be enough to chip away at rent, groceries, or your phone bill, without chasing risky high yield traps or learning options trading?

That’s exactly what I set out to prove.

In this guide, I’ll show you how I’d invest $10,000 right now using traditional income ETFs, monthly dividend payers, and rock solid Business Development Companies to start earning immediately and build toward $500 per month in passive income the realistic way.

Why This Approach Works

Too many income strategies promise big yields at the cost of your capital. But what if your goal is stability, not speculation?

If I had $10,000 to invest today and wanted to build towards earning $500/month in passive income, I wouldn’t chase exotic funds or risky options. I’d focus on quality, consistency, and reinvestment.

Here’s exactly how I’d structure it using well-known dividend ETFs, BDCs, and monthly income funds that anyone can access without margin, leverage, or hype.

This Isn’t a Total Return Portfolio And That’s the Point

Let’s be clear. This portfolio isn’t designed to beat the market or maximize long-term capital gains. It’s built for one purpose:

To generate consistent, reliable cash flow.

While traditional portfolios often focus on growth by buying low, selling high, and reinvesting capital gains, this one flips the script. Every dollar is chosen based on how much income it can generate right now and how consistently it can deliver that income going forward.

That means:

You may underperform the S&P 500 in bull markets

Your portfolio might not grow as fast over time

But you'll get real cash in your account each month

This tradeoff is intentional.

You’re prioritizing monthly income over long-term appreciation. And for many investors, especially those who want to pay bills, cover expenses, or build a self-funding lifestyle.

Think of it as building your own personal pension. One that grows steadily, pays you regularly, and doesn’t require selling shares to access cash.

If you want long-term growth, there are better strategies. For instance, consider this model portfolio that outperforms the S&P 500.

This Dividend Portfolio Outperforms & Pays You Forever

If you have ever felt overwhelmed by investing, you are not alone. The financial world can feel confusing and full of noise. There are countless opinions, strategies, and products being marketed every day. It is easy to freeze, overthink, or feel like you need thousands of dollars and years of experience before you can get started.

The Realistic Yield Approach

Let’s be honest: $10,000 won’t pay you $500/month on day one.

(Actually, it can if you just buy an asset that yields 60%)

Such as YieldMax Magnificent 7 Fund of Option Income ETFs (YMAG), but this is extremely risky and I would not recommend you do this as a beginner investor.

Anyways, $10,000 won’t pay you $500/month on day one but it can generate $70–$100/month right away using reliable income assets.

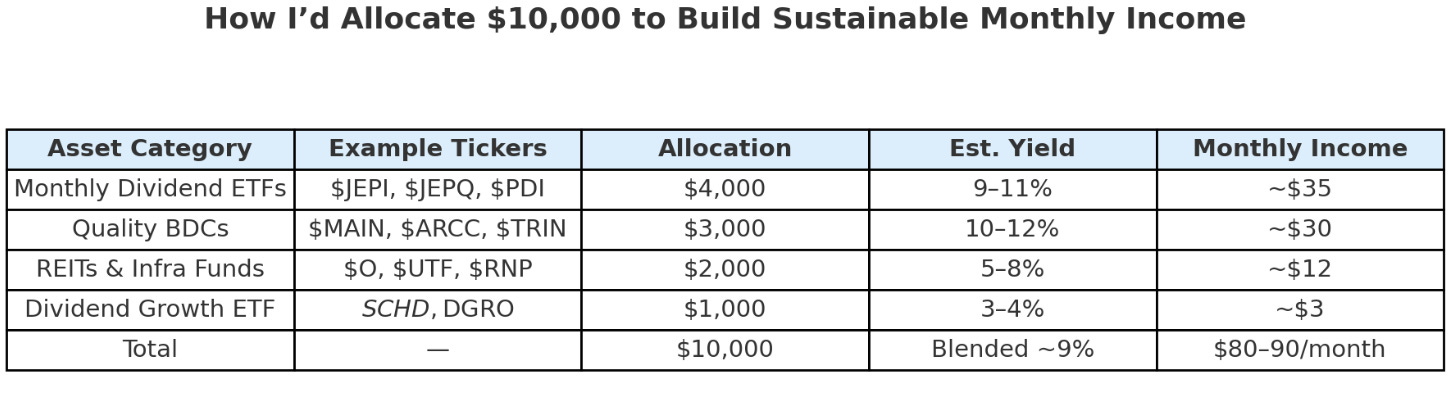

The key is to reinvest, stay consistent, and compound your cash flow over 2–4 years. Here’s how I imagine that process going and here are some of the tickers that I do believe to be suitable for beginners.

Why These Picks?

✅ Monthly Dividend ETFs

These provide steady income using covered calls or diversified debt. Funds like JEPI and JEPQ give 8–11% with much lower volatility than aggressive yield-chasers. The monthly payouts mean that you have greater control over how you want to reinvest those dollars.

10 Monthly Dividend Stocks That Pay Me $1,688💸

Most investors wait every quarter to collect their dividends.

✅ Top-Tier BDCs

Business Development Companies like MAIN and ARCC yield 9–12% and invest in private credit and lending. Many pay monthly and have long-term track records of dividend stability. A BDC, or Business Development Company, is like a publicly traded investment fund that lends money to private businesses, mainly small and mid-sized companies that don’t have access to traditional bank loans.

Think of a BDC as a bridge between Wall Street and Main Street. You invest in the BDC, and the BDC uses your money to provide funding to growing companies. In return, the BDC collects interest, fees, and sometimes even equity and passes a big portion of those profits back to you as a shareholder.

Here’s why BDCs are attractive for income investors:

📦 They pay out 90% of their income to shareholders by law

💰 Yields are often 8 to 12 percent or higher

🔁 Many pay dividends monthly or quarterly

Some of the best-known BDCs like Main Street Capital (MAIN) or Ares Capital (ARCC) have a long track record of delivering high, steady dividends while investing in real companies behind the scenes.

For investors who want strong income without wild speculation, BDCs can be a powerful part of the portfolio.

$MAIN – Main Street Capital is one of the most respected names in the BDC space with a steady monthly dividend.

$ARCC – Ares Capital is one of the largest BDCs, offering strong credit underwriting and long-term dividend reliability.

$TRIN – Trinity Capital targets tech and venture lending, offering higher yield with manageable risk.

✅ REITs & Infrastructure

Adding names like Realty Income ($O) or Cohen & Steers UTF gives you exposure to property, infrastructure, and utilities. These are sectors that hold up during inflation. A REIT, or Real Estate Investment Trust, is a company that owns or finances income-producing real estate: everything from apartments and shopping centers to data centers and cell towers.

$O – Realty Income, famously known as "The Monthly Dividend Company," owns essential retail and commercial properties.

$UTF – Cohen & Steers Infrastructure Fund provides exposure to utilities, infrastructure, and global income-generating assets.

$RNP – Focuses on preferred securities and REITs for steady income and inflation protection.

Here’s the key: REITs are legally required to pay out at least 90% of their taxable income as dividends. That means they’re built for income. You don’t have to be a landlord, deal with tenants, or buy physical property. You just invest in the REIT and collect the dividends.

There are different types of REITs:

🏢 Equity REITs own real estate and collect rent (like Realty Income, ticker O)

🏗️ Infrastructure REITs focus on things like utilities and data (like UTF)

💳 Mortgage REITs lend money for real estate and earn interest

REITs are popular with income investors because:

They pay consistent monthly or quarterly dividends

They offer exposure to real assets without the hassle

They often do well in inflationary environments

✅ Dividend Growth ETFs

Growth ETFs like SCHD won’t pay much now, but they help balance the portfolio and gradually increase your income over time.

Why This Might Be the Greatest Dividend Growth ETF Ever Created

We are living in an era where inflation is no longer a background risk. It is front and center. While it has cooled from its 2022 peak, core inflation in the United States still hovers above the Federal Reserve’s two percent target, and many essential goods and services continue to rise in price year over year.

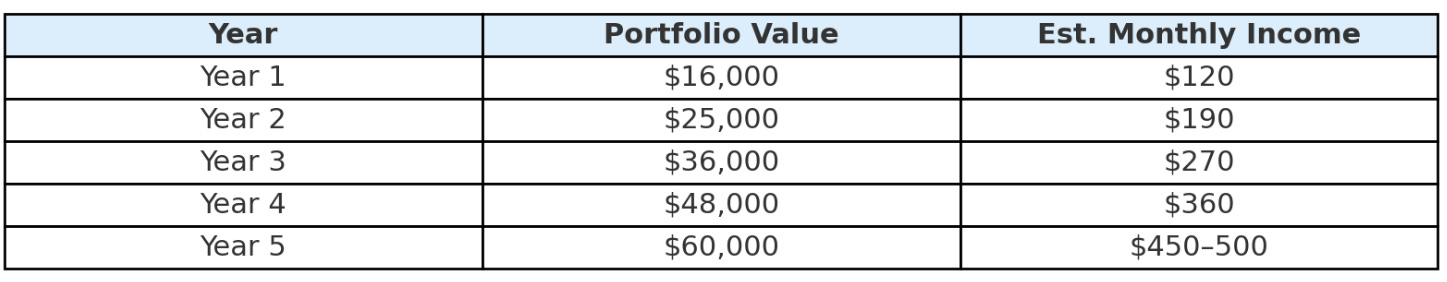

How $80/Month Grows Into $500/Month

Here’s the plan:

🔁 Step 1: Reinvest Every Payout

Your first month might only pay you $80–$90 in dividends. But instead of withdrawing it, you reinvest that cash into more income-generating assets.

This is where the compounding magic starts.

Example: If you reinvest $90 into an ETF yielding 10%, that adds another ~$9/year in future income… forever.

Month by month, your dividend snowball gets bigger and each reinvested payout buys you more monthly cash flow.

💵 Step 2: Add Monthly Contributions

Reinvesting helps but if you want to accelerate the path to $500/month, regular contributions make a huge difference.

If you can add:

$250/month → You’re adding $3,000/year to your income engine

$500/month → You’re doubling your base in just one year

Even small contributions, combined with compounding, can dramatically shorten your timeline. We’re talking about dedicating one year of focus towards building another income stream for yourself. I believe it’s a good use of time and a solid tradeoff.

Sample Projection (Assumes 9% yield + reinvestment + monthly contributions):

That’s your $500/month built on realistic, proven income streams, not high-risk gimmicks.

🧠 Why This Strategy Is Beginner-Friendly

✔️ Easy to manage (you can use a platform like M1 or Fidelity)

✔️ Monthly payouts help you stay engaged

✔️ Zero margin or leverage risk

✔️ Diversified across sectors, income types, and asset classes

Most importantly, it’s repeatable. This is a blueprint you can build on for life, scaling from $10K to $100K and beyond with confidence.

✅ Final Thoughts

You don’t need to chase wild yields or overcomplicate your portfolio to build real income. With $10,000, the right mix of traditional ETFs, BDCs, and monthly dividend funds can get you started and if you stay disciplined, you’ll be surprised how fast it grows.

📊 Tool: Track Your Progress

Want to keep track of what you're earning, how much your portfolio yields, and where to reinvest?

📥 Dividend Tracker Template – $5

Simple, powerful Google Sheet to track your holdings, income, yield-on-cost, reinvestment, and more.

📘 Full System: Go From $0 to $500/Month in Income

If you’re ready to build a scalable dividend income portfolio from scratch, with real structure, strategy, and support. You can start here:

🚀 The Dividend Income Blueprint – $25

My complete guide that shows how I built over $3,000/month in passive income using a three-layer dividend system, reinvestment strategy, and sustainable yield portfolio design.

It includes:

The strategy I use

Portfolio structure breakdown

Real examples + reinvestment tactics

Income planning + risk controls

Bonus: Checklist, glossary, & asset filters

Want to get a well-rounded idea of where to start your investing journey? I have you covered here as well!